Specialty Household Cleaners Market - Global Industry, Analysis, Size, Share, Growth, Trends, and Forecasts 2023-2030

- Category: Consumer Goods

- Report ID: CMR13383

- Upcoming

Specialty cleaning agents or hard-surface cleaners are substances usually liquids, powders, sprays, or granules used to remove dirt, including dust, stains, foul odors, and clutters on the surface. Household products are used to clean fabrics, dishes, food utensils, and household and commercial premises. Specialty cleaners are formulated for specific surfaces like glass tile, metal, ovens, carpets, toilet bowls, and drains. Household cleaning product does not mean foods, drugs, cosmetics, or personal care items such as toothpaste, shampoo, and hand soap. Household cleaning products help in achieving good personal hygiene, reducing the presence of germs that cause infectious diseases extending the life of household products, and making homes and workplaces more healthy and pleasant. Some cleaning agents can kill bacteria example, door handles bacteria as well as bacteria on worktops and other metallic surfaces. Others, called degreasers contain organic solvents to help dissolve oils and fats. Different chemical agents are included in household cleaners such as acidic cleaning agents mainly used for the removal of deposits like scaling. Hydrochloric acid common mineral acid used for concrete, and vinegar is also used to clean hard surfaces and calcium deposits. Alkaline cleaning agents contain strong bases, ammonia is a common alkaline cleaning agent. Based on usage and application, the four main types of household cleaning products are floor cleaners, glass cleaners, wood cleaners, and toilet bowl cleaners. within these different categories, different types of products are available, which are formulated with products and ingredients to perform a comprehensive range of cleansing functions as well as to impact specific properties of the product. An understanding of the different products and their specific ingredients and functions will help in selecting the right product for specific cleaning applications.

The global market of specialty household cleaners is benefiting from increased focus on the importance of sanitary conditions and the need to disinfect household surfaces. Marketing of household cleaners and innovation will prove important over the coming years. Companies must be quick to meet changing demand and keep up with shifting trends through household product innovations.

Global Specialty Household Cleaners Market – Competitive Landscape

On June 19, 2023, Us-based specialty chemicals firm Lubrizol Corp invested USD 150 million In India, its largest yet investment in the country’s household-led infrastructure, and home products in the country. On June 13, 2023, ABB acquired Eve Systems GmbH, a Munich-based provider of smart home products. On June 16, 2023, Unilever and Geno launched a USD 120 million venture to scale alternative ingredients used in everyday cleaning and personal care products. On June 5, 2023, Solenis a leading manufacturer of specialty chemicals completed the acquisition of Diversey Holdings Ltd. With enterprises valued at USD 4.6 billion.

Some of the Key Players in the Global Specialty Household Cleaners Market Include –

- Colgate Palmolive

- McBride

- Church and Dwight

- Hankel

- Kao Corporation

- Godrej Consumer product

- Clorox Company

- Procter and Gamble

- Reckitt Benckiser Group

- SC Johnson& Son

Global Specialty Household Cleaners Market – Growth Drivers

Manufacturers and brands that can offer specialty cleaners at competitive prices are likely to attract a larger customer base. Cost-effective production methods and efficient supply management can help companies maintain competitive pricing which drives the global specialty household cleaner market. According to the National Center for Biotechnology Information Implementing cost of cleaning products is USD 349,000 saving up to USD 93,441.25. Increased awareness of cleanliness and hygiene, especially in the global health concern is driving demand for specialized cleaning products. Consumers are increasingly looking for eco-friendly and sustainable cleaning solutions leading development of specialty cleaners. The rise of e-commerce has made specialty cleaners more accessible to consumers allowing for convenient online purchasing and delivery options. Dishwashing products are the most lucrative segment of the global specialty household cleaners market followed by surface and toilet cleaners. According to Statista by 2025 dishwashing products forecast around USD 12.9 billion globally. Urbanization and changing lifestyles have increased the demand for time-saving and efficient cleaning products with specialty cleaners often provided.

Global Specialty Household Cleaners Market – Restraints

The cost of raw materials especially specialty cleaners’ ingredients can be higher. This cost can affect the limited profit margins and affordability of products. Increased awareness of environmental issues may lead to scrutiny of the environmental impact of cleaning products. So the manufacturing of eco-friendly products can be more expensive. Some consumers may resist switching from traditional cheaper cleaning products to specialty cleaners particularly if they face the price difference as too high. Disruption in the supply chain, such as the Covid-19 pandemic can lead to shortages of essential ingredients or packaging materials affecting production and distribution. The growth of private-label or store-brand cleaning products can compete with branded specialty products and often offer low prices. Fluctuations in the rates and global economic conditions can affect the cost of imports and exports so it affects the profitability of companies operating in the global specialty household cleaners market.

Global Specialty Household Cleaners Market – Opportunities

The increasing consumer demand for eco-friendly and sustainable cleaning solutions presents a significant opportunity. Manufacturers can develop and market specialty cleaners that are biodegradable, non-toxic, and environmentally friendly. Different innovative cleaning formulations are effective, safe, and have specific cleaning needs that capture the specialty household cleaners market. Providing tailored cleaning solutions for specific applications such as automotive electronic devices or niche surfaces can create a loyal customer base and specialty household cleaners market. Focus on healthcare and hygiene has continuously increased after the pandemic so the ongoing demand for specialty household cleaners market increased.

Global Specialty Household Cleaners Market – Geographical Insight

The market for global specialty household cleaners is segmented into the regions of North America, Latin America, Europe, Asia-Pacific, the Middle East, and Africa. North America is the largest market due to the growing preference for eco-friendly and natural cleaning products, Increased awareness for health and hygiene boosted the demand for disinfectants and specialty cleaners. Asia-Pacific is a rapidly growing market due to urbanization, and changing lifestyles. There’s rising demand for specialty cleaners in emerging markets like China and India driven by health awareness and product innovation. European consumers are also focused on inclined toward green cleaning products.

Global Specialty Household Cleaners Market – Key Development

- On March 24, 2023, Procter and Gamble launched its first-ever spring limited edition collection across its home and fabric brands.

- On November 28, 2022, Gelnova Hygiene launched FreshenGo 123 Wash, the new generation of household products.

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

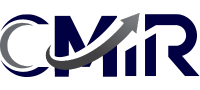

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

- We initiate in-depth discussions and consultations with our clients to gain a comprehensive understanding of their objectives. This involves actively listening to their needs, concerns, and aspirations regarding the research project.

- Through these interactions, we aim to uncover the underlying motivations driving their research requirements and the specific outcomes they hope to achieve.

Industry and Market Segment Analysis:

- We invest time and effort in comprehensively understanding our clients’ industry and market segment. This involves conducting thorough research into market trends, competitive dynamics, regulatory frameworks, and emerging opportunities or threats.

- By acquiring a deep understanding of the broader industry landscape, we can provide context-rich insights that resonate with our clients’ strategic objectives.

Target Audience Understanding:

- We analyze our clients’ target audience demographics, behaviors, preferences, and needs to align our research efforts with their consumer-centric objectives. This entails segmenting the audience based on various criteria such as age, gender, income level, geographic location, and psychographic factors.

- By understanding the nuances of the target audience, we can tailor our research methodologies to gather relevant data that illuminates consumer perceptions, attitudes, and purchase intent.

Identifying Challenges and Opportunities:

- We proactively identify the challenges and opportunities facing our clients within their respective industries. This involves conducting SWOT (Strengths, Weaknesses, Opportunities, Threats) analyses and competitive benchmarking exercises.

- By identifying potential obstacles and growth drivers, we can provide strategic recommendations that help our clients navigate complexities and capitalize on emerging opportunities effectively.

Grasping Specific Goals:

- We delve into the intricacies of our clients’ objectives to gain clarity on the specific goals they aim to accomplish through the research. This entails understanding their desired outcomes, such as market expansion, product development, or competitive analysis.

- By gaining a nuanced understanding of our clients’ goals, we can tailor our research approach to address their unique challenges and opportunities effectively.

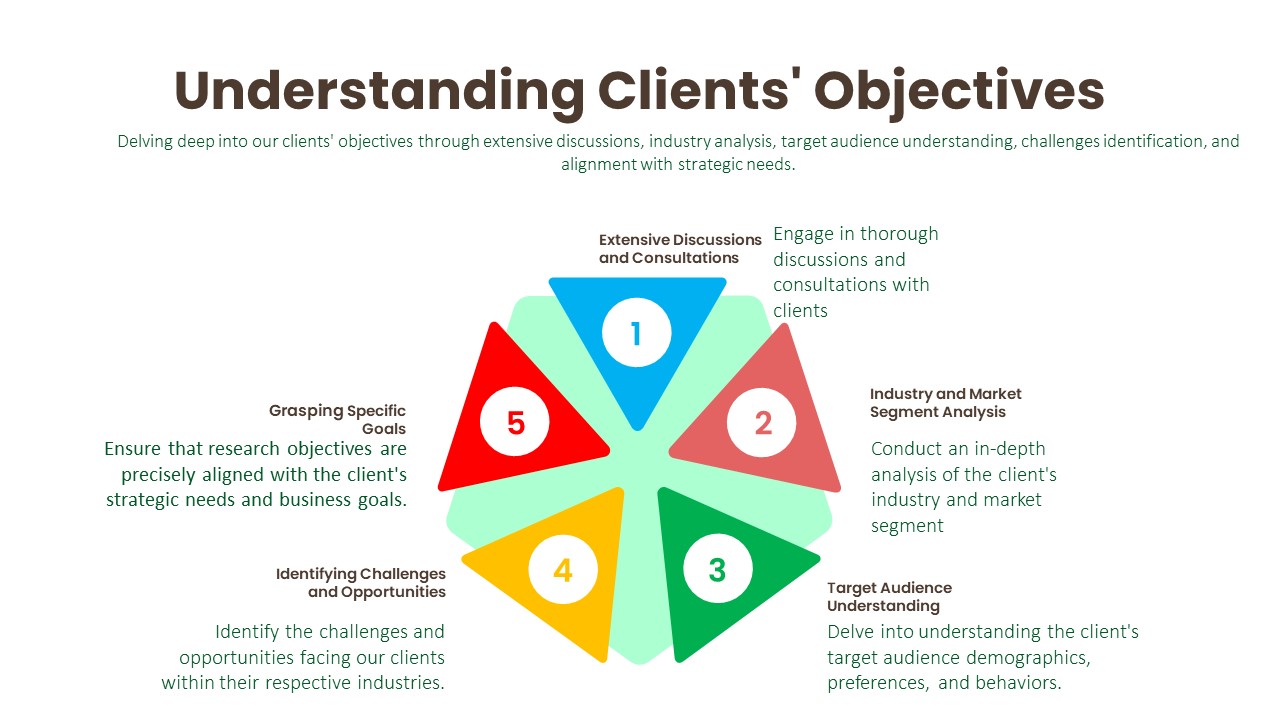

Data Collection:

Primary Research Process:

- Surveys: We design and administer surveys tailored to capture specific information relevant to our clients’ objectives. This may involve employing various survey methodologies, such as online, telephone, or face-to-face interviews, to reach target audiences effectively.

- Interviews: We conduct structured or semi-structured interviews with key stakeholders, industry experts, or target consumers to gather in-depth insights and perspectives on relevant topics. These interviews allow us to probe deeper into specific issues and uncover valuable qualitative data.

- Focus Groups: We organize focus group discussions with carefully selected participants to facilitate interactive discussions and gather collective opinions, attitudes, and preferences. This qualitative research method provides rich contextual insights into consumer behaviors and perceptions.

- Observations: We conduct observational research by directly observing consumer behaviors, interactions, and experiences in real-world settings. This method enables us to gather objective data on consumer actions and reactions without relying on self-reported information.

Secondary Research Process:

- Literature Review: We conduct comprehensive literature reviews to identify existing studies, academic articles, and industry reports relevant to the research topic. This helps us gain insights into previous research findings, theoretical frameworks, and best practices.

- Industry Reports: We analyze industry reports published by reputable trade associations (whitepapers, research studies, etc.), and government agencies (U.S. Census Bureau, Bureau of Labor Statistics, and Securities and Exchange Commission etc.) to obtain macro-level insights into market trends, competitive landscapes, and industry dynamics.

- Government Publications: We review government publications, such as economic reports, regulatory documents, and statistical databases, to gather relevant data on demographics, market size, consumer spending patterns, and regulatory frameworks.

- Online Databases: We leverage online databases, such as industry portals, and academic repositories (PubMed Central (PMC), ScienceDirect, SSRN (Social Science Research Network), Directory of Open Access Journals (DOAJ), NCBI, etc.), to access a wide range of secondary data sources, including market statistics, financial data, and industry analyses.

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

- Upon collecting the necessary data, we transition into the data analysis phase, where raw data is processed and transformed into actionable insights. This involves organizing, cleaning, and structuring the data to prepare it for analysis.

Utilization of Analytical Methods:

- Depending on the research objectives, we employ a diverse range of analytical methods to extract meaningful insights from the data. These methods include statistical analysis, trend analysis, regression analysis, and qualitative coding.

Statistical Analysis:

- Statistical tools are instrumental in uncovering patterns, correlations, and trends within the data. By applying statistical techniques such as descriptive statistics, hypothesis testing, and multivariate analysis, we can discern relationships and derive valuable insights.

Qualitative Analysis Techniques:

- In addition to quantitative analysis, we leverage qualitative analysis techniques to gain deeper insights from qualitative data sources such as interviews or open-ended survey responses. One such technique is thematic coding, which involves systematically categorizing and interpreting themes or patterns within qualitative data.

Integrity and Validity Maintenance:

- Throughout the analysis process, we maintain a steadfast commitment to upholding the integrity and validity of our findings. This entails rigorous adherence to established methodologies, transparency in data handling, and thorough validation of analytical outcomes.

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

- Data validation is the final phase of the research methodology, crucial for ensuring the reliability and credibility of the findings. It involves a systematic process of reviewing and verifying the collected data to detect any inconsistencies, errors, or biases.

Scrutiny of Collected Data:

- The validation process begins with a thorough scrutiny of the collected data to identify any discrepancies or anomalies. This entails comparing data points, checking for outliers, and verifying the accuracy of data entries against the original sources.

Validation Techniques:

- Various validation techniques are employed to ensure the accuracy and integrity of the data. These include cross-referencing data from multiple sources to corroborate findings, conducting validity checks on survey instruments to assess the reliability of responses, and seeking feedback from independent experts or peer reviewers to validate the interpretation of results.

Internal Quality Assurance Protocols:

- In addition to external validation measures, internal quality assurance protocols are implemented to further validate the accuracy of the analysis. This may involve conducting internal audits, peer reviews, or data validation checks to ensure that the research process adheres to established standards and guidelines.

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail