Mobile wallet also referred to as mobile money or mobile money transfer, A Mobile wallet is a type of virtual wallet that stores credit card numbers, debit card numbers, and loyalty card numbers. It is accessible through an app installed on a mobile device, such as a mobile devices or tablet. Instead of paying with cash, cheques, or credit cards, a consumer can use payment app, customers use mobile wallets to make in-store payments and it is a convenient payment method compared to paying with cash or carrying physical credit cards. Mobile wallets are accepted as a method of payment in stores that are listed with mobile service providers. The most popular mobile wallets include Phonepe, Google Pay, Paytm, and Amazon Pay. The wallets are integrated into mobile devices, or users can download the application from app stores. Although the concept of using non-coin-based currency systems has a long history, it is only 21st century that the technology to support such systems has become widely available. The first patent exclusively defined “Mobile Payment System” was filed in 2000. The information stored in the mobile wallets is encrypted it is difficult for cybercriminals to execute fraudulent activities with them. Once customer installs mobile wallet on their mobile they need to provide their credit card or debit card details to start all the payment services. The information is linked to an acceptable personal identification format such as a scannable QR code.

Mobile wallets enable transactions to be completed instantly. The mobile wallet app uses an information transfer technology like near-field communication (NFC) which uses radio frequencies to communicate between two devices. Mobile wallets are encrypted software so the money of the consumer is protected. Mobile wallets have many other uses such as flight booking, online shopping, bill payment, and money transfer. With regards to future mobile payment technology, mobile wallets are one of the fastest-growing segments mainly because of convenience, security, ease of use, and fast service delivery.

Global Mobile Wallet Market – Competitive Landscape

On May 23, 2023, General Atlantic which is an American growth equity firm declared its investment worth USD 100 million in digital payment firm owned by Walmart Inc as a part of its USD 1 billion investing round. On May 31, 2023 wallet-as-a-service provider Magic has raised USD 52 million in a round led by PayPal Ventures. On October 22, 2021, mobile wallet infrastructure startup Citcon raised USD 30 million in a series c funding round led by Norwest Venture Partners with participation by Sierra Ventures.

Some of the Key Players in the Global Mobile Wallet Market Include –

Global Mobile Wallet Market – Growth Drivers

The increase in internet and smartphone penetration plays a major role in the growth of the global mobile wallet market. It is a major driver for the growth of digital payments apps. According to National Information Center (NIC), the global market for mobile wallets reach USD 200 billion by 2026. The rise of non-banking payment institution, progressive regulatory policies and increasing consumer readiness to the payment platform drives the growth of the global, mobile wallet market. Digital payment is a positive policy framework change and the government takes initiatives like UPI, Aadhar-linked electronic payments, and improvements in digital infrastructure. Unified payments interface (UPI) helped to accelerate the adoption rate of mobile wallets processing transactions of USD 226 billion according to the National Center for Biotechnology Information (NCBI). COVID-19 fueled it to greater heights as social distancing became the norm and buyers and vendors favored contactless payments.

Global Mobile Wallet Market – Restraints

Security and privacy issues are the major concern for users a fear of fraud, and access of information can hinder the widespread of the global mobile wallet market. Different countries have different regulations for mobile wallets which creates barriers to worldwide expansion of mobile wallets. Not all merchants and businesses accept the mobile wallet payment which limits the service. In some regions the rise in poor network connectivity which restricts the customer’s use of mobile wallets. The market is highly competitive with numerous companies, which leads to fragmentation and confusion for consumers. Users may face transaction fees and some people are discouraged by the potential costs associated with mobile wallet usage. Some peoples lack access to smartphones or the necessary technology which prevents the use of mobile wallets. Building trust in the technology is crucial, many users are still hesitant to fully embrace mobile wallets due to concerns about reliability and user experience.

Global Mobile Wallet Market – Opportunities

The growing preference for contactless payments especially after the COVID-19 pandemic creates a significant opportunities for mobile wallet providers. Mobile wallets can be integrated with various services like transportation, loyalty programs and more enhancing their utility and user engagement. High smartphone penetration in the markets provides a vast customer base for mobile wallet adoption. Incorporating blockchain and cryptocurrencies into mobile wallets can offer users more options and potentially reduce transaction costs. Collaboration with finance companies, banks, and merchants can expand the ecosystem of mobile wallet services. Features like biometric authentication can boost user trust and make mobile wallets more appealing.

Global Mobile Wallet Market – Geographical Insight

The market for global mobile wallets is segmented into regions such as North America, Latin America, Europe, Asia-Pacific, the Middle East & Africa. North America is the largest market for global mobile Wallets with prominent players like Apple Pay, Google Pay, and Samsung Pay. Contactless payment use has been on the rise, especially in countries such as United States and Canada. Asia-Pacific is the growing market in the global mobile wallet with significant uses in countries like China, India, and South Korea. Mobile wallets such as Alipay and WeChat Pay in China have become integral to daily life. In the European regions, the European Union’s Payment Services Directive 2 has encouraged innovation in mobile wallet payment.

Global Mobile Wallet Market – Key Development

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

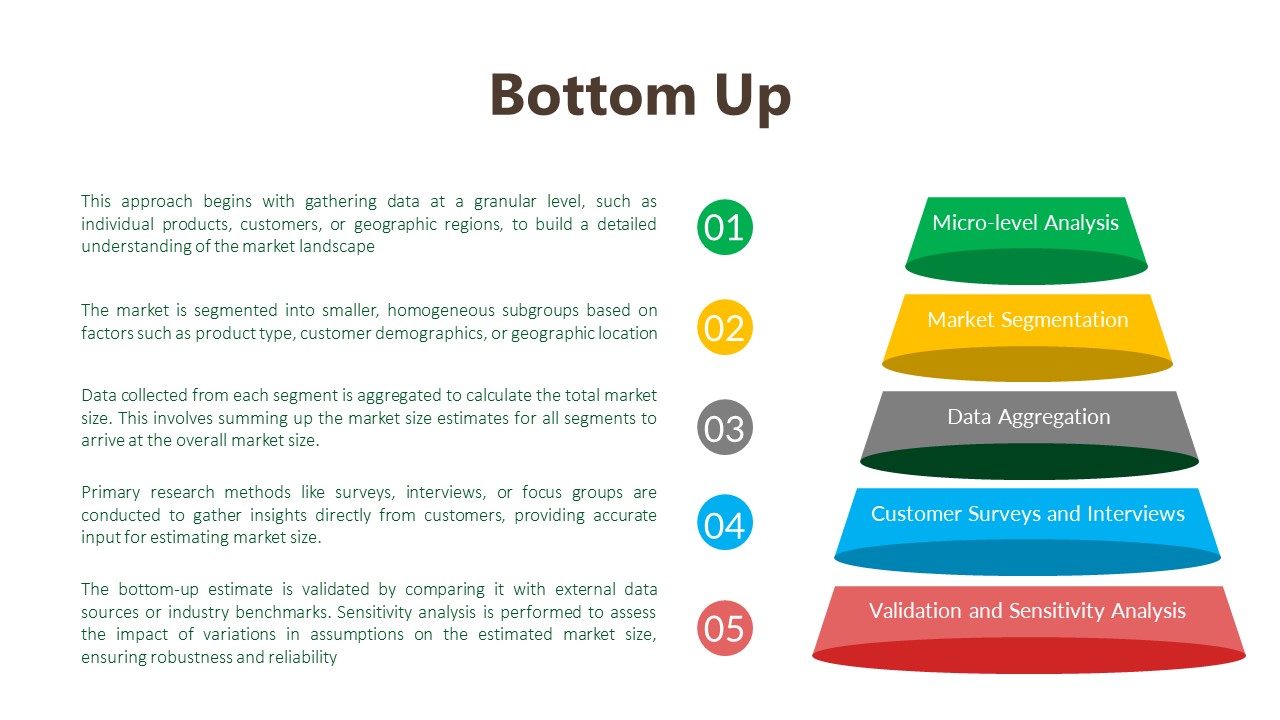

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

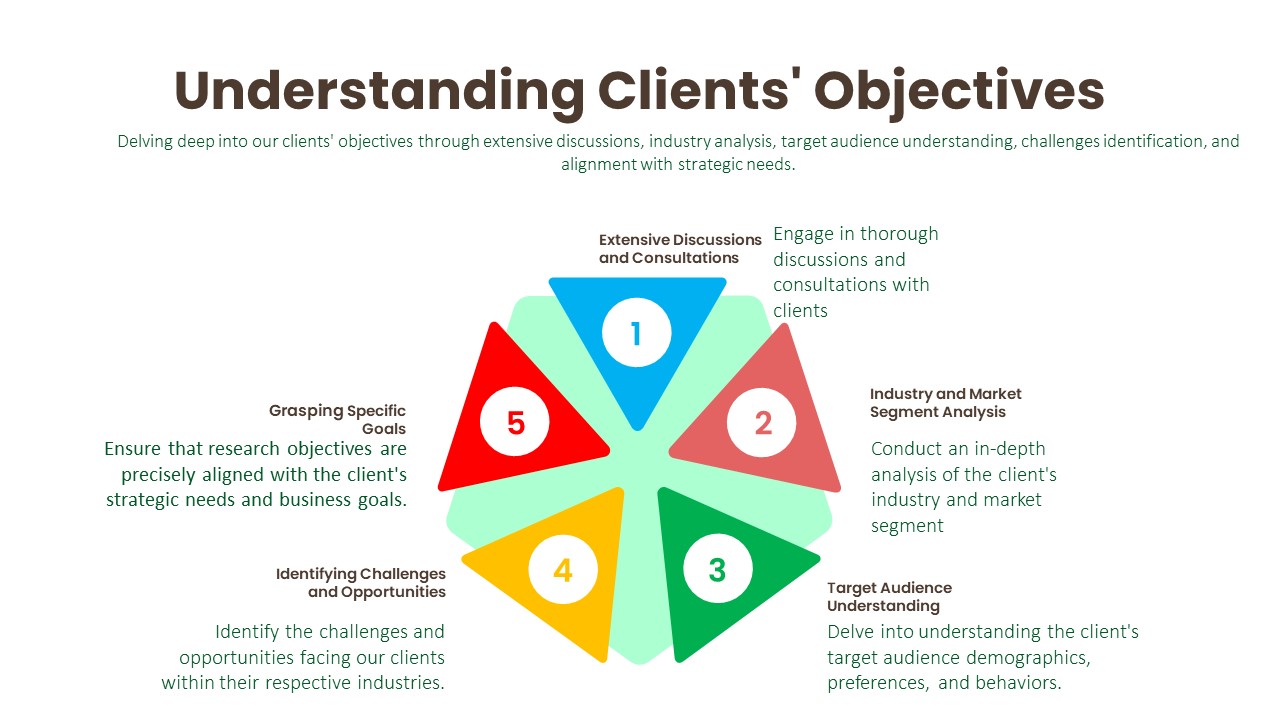

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

Industry and Market Segment Analysis:

Target Audience Understanding:

Identifying Challenges and Opportunities:

Grasping Specific Goals:

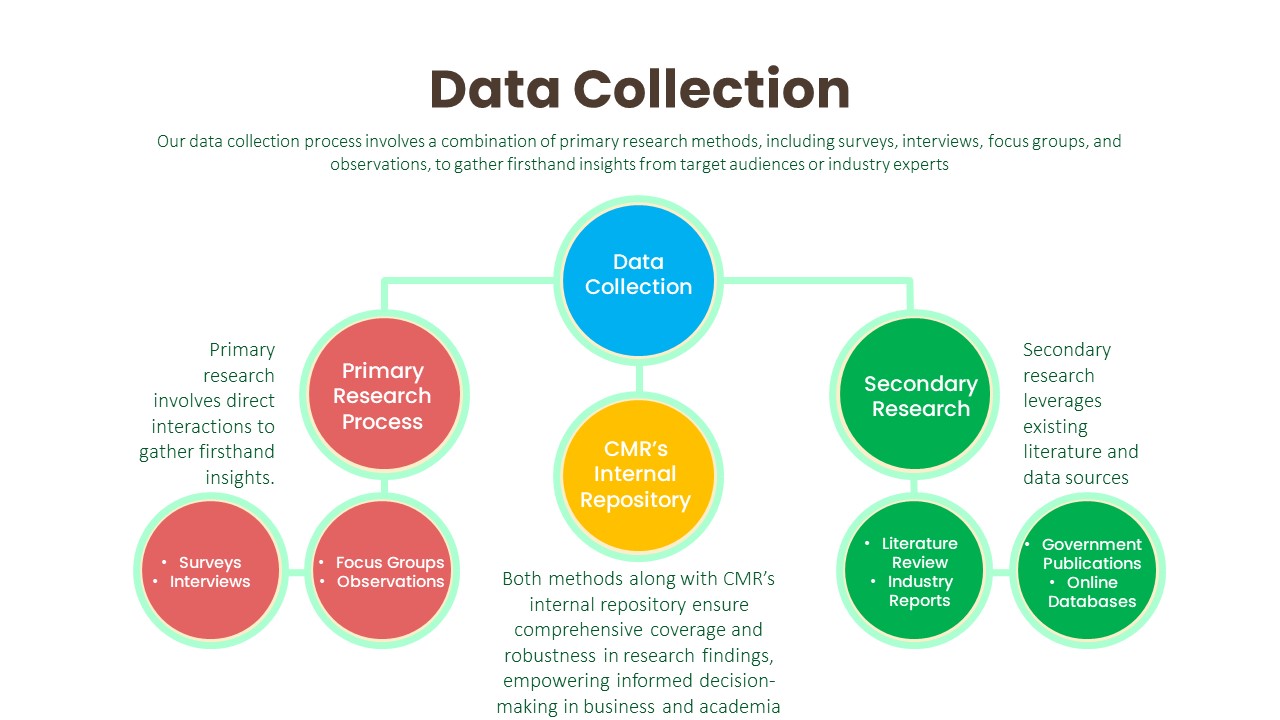

Data Collection:

Primary Research Process:

Secondary Research Process:

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

Utilization of Analytical Methods:

Statistical Analysis:

Qualitative Analysis Techniques:

Integrity and Validity Maintenance:

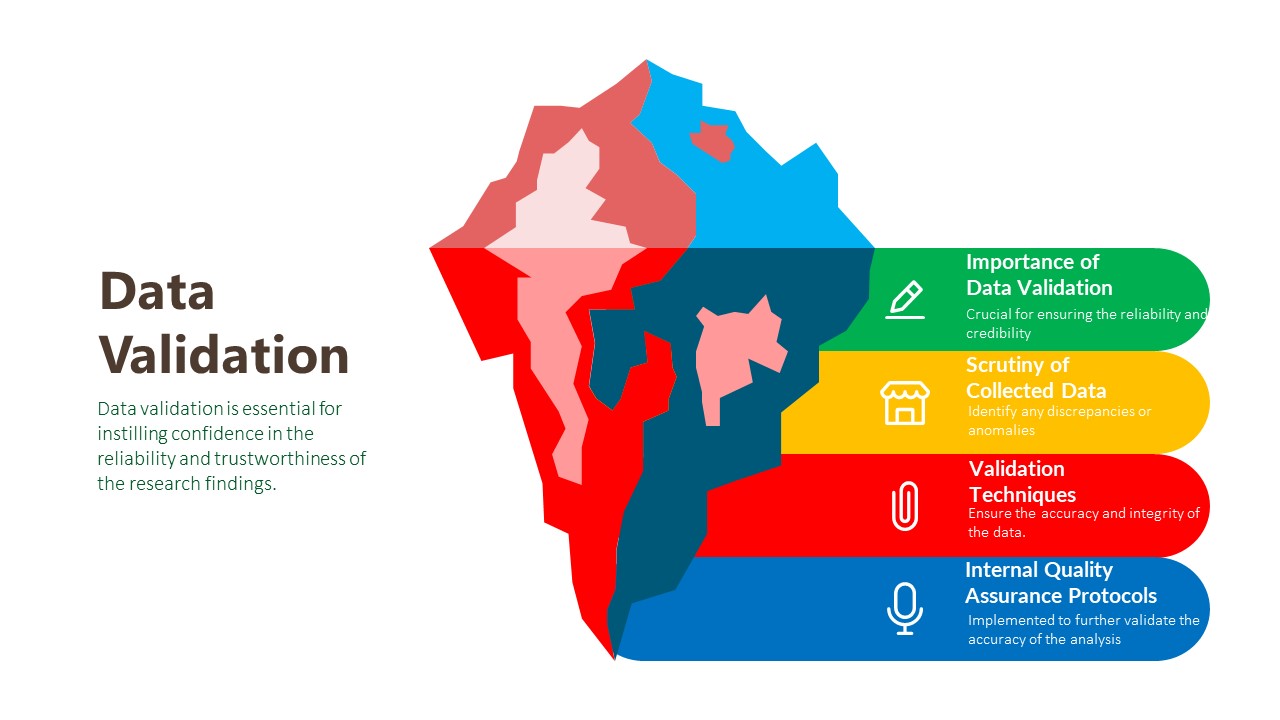

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

Scrutiny of Collected Data:

Validation Techniques:

Internal Quality Assurance Protocols:

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail

Cognizance market research is continuously guiding customers around the globe towards strategies for transformational growth. Today, businesses have to innovate more than ever before, not just to survive, but to succeed in the future

© 2023 All rights Reserved. Cognizance Market Research