Distributed Energy Generation System Market - Global Industry, Analysis, Size, Share, Growth, Trends, and Forecasts 2023-2030

- Category: ICT, Automation and Semiconductor

- Report ID: CMR14149

- Upcoming

Distributed energy generation refers to a variety of technologies that generate electricity at or near it will be used, such as solar panels, combined heat, and power. Distributed generation may serve a single structure, such as a home or business, or it may be part of a microgrid (a smaller grid that is also tied into the larger electricity delivery system), such as at a major industrial facility, military base, or a large college campus. When connected to the electric utility lower voltage distribution lines, distributed generation can help support the delivery of clean, reliable power to additional customers and reduce electricity losses along transmission and distribution lines. In the residential sector, common distributed generation system includes solar photovoltaic panels, small wind turbines, natural-gas-fired fuel cells, and emergency backup generators, usually fueled by gasoline or diesel fuel. In the commercial and industrial sectors, distributed generation can include resources such as combined heat and power systems, hydropower, biomass combustion or cofiring, fuel cells fired by natural gas or biomass, and wind.

Increasing numbers of distributed energy sources are connected to the distribution network and the evolving smart grids. It is possible to the grid through microgrids. Consumers who install distributed energy resource units may be able to reduce the price they pay for electricity or may obtain improved reliability outcomes. Distributed generation systems are subject to a different mix of local, state, and federal policies, regulations, and markets compared with centralized generation. Distributed generation can benefit the environment if its use reduces the amount of electricity that must be generated at centralized power plants, in turn, can reduce the environmental impacts of centralized generation,

Global Distributed Energy Generation (DEG) System Market – Competitive Landscape

On August 9, 2023, Portugal’s EDP reported that they plan to invest USD 2.7 billion in distributed solar generation globally up to 2026. On May 30, 2023, Mitsubishi Electric and Mitsubishi Heavy Industries signed an agreement to combine their power generator systems businesses. On April 20, 2023, Sunergy Renewables Florida-based residential solar and energy efficiency installer, announced plans to go public at USD 475 million enterprise value. They announced to intent to combine with ESGEN Acquisition value.

Some of the Key Players in the Global Distributed Energy Generation (DEG) System Market Include

- Siemens

- General Electric Co.

- Constellation Energy Corp.

- Mitsubishi

- NTPC Ltd.

- Doosan

- NextEra Energy

- Capstone

- Adani Power Limited

- Tata Power Co. Ltd.

Global Distributed Energy Generation (DEG) System Market – Growth Drivers

Cost-effective global distributed energy generation systems can be used worldwide which is the largest growth factor for the global distributed energy generation system market. The electricity cost reported according to the National Center for Biotechnology Information (NCBI) is USD 5 to USD 10 per watt installed. Businesses and communities can gain greater control over their energy supply, reducing their dependence on external energy sources, this independence is attractive in remote locations or regions with unreliable grids. The increasing focus on reducing carbon emissions and mitigating climate change is driving the adoption of distributed energy systems, such as solar and wind power, which are cleaner and more sustainable energy sources. Advances in renewable energy technologies, energy storage, and smart grid solutions make distributed generation more efficient and accessible. Many governments offer incentives, subsidies, and tax credits to encourage the adoption of distributed energy generation systems, making them more financially attractive. The development of microgrids, which are localized energy grids that can operate independently or in conjunction with the central grid, is a significant growth driver for the globally distributed energy generation systems market.

Global Distributed Energy Generation (DEG) System Market – Restraints

The starting capital cost of installing distributed energy generation systems, such as solar panels or wind turbines is costly this can deter with limited access to financing. According to the Energy Information Administration construction cost of solar panels is up to USD 1,655 per Kilowatt. Renewable energy sources, such as solar and wind are dependent on nature, so the availability of weather conditions makes it challenging to maintain consistent energy supply without energy storage solutions. Energy storage technologies such as batteries are too expensive, which reduces the economic viability of some distributed energy projects. Integrating distributed energy generation into existing power grids can be complex and costly, which requires infrastructure upgrades. Economic conditions and fluctuations in energy prices can influence investment decisions in distributed energy generation, impacting market growth. While distributed energy systems are generally cleaner than fossil fuels, there can still be environmental concerns, such as the environmental impact of manufacturing solar panels or wind turbines.

Global Distributed Energy Generation (DEG) System Market – Opportunities

Opportunities exist in the integration of distributed energy systems with smart grids, enabling real-time monitoring and control to optimize energy generation and consumption. The development of hybrid energy systems, combining multiple renewable energy sources and energy storage, can enhance system efficiency and reliability. The expansion of microgrid systems offers opportunities for localized energy generation and distribution, providing energy security and grid, especially in remote locations. Ongoing technological advancements and innovation in distributed energy solutions create opportunities for companies to develop and market more efficient and cost-effective products.

Global Distributed Energy Generation (DEG) System Market – Geographical Insight

The market for globally distributed energy generation systems is segmented into regions such as North America, Latin America, Europe, Asia-Pacific, the Middle East &Africa. The largest market for globally distributed energy generation systems in North America due to incentives and policies at the federal and state levels to promote renewable energy adoption and microgrid development, particularly in areas prone to natural disasters. European countries are leaders in renewable energy uses, with a strong emphasis on wind and solar power. European countries target to reduce carbon emissions in clean energy technologies. China from the Asia-Pacific region is a significant player in the distributed energy generation market with a focus on solar and wind energy. India is expanding its renewable energy capacity and promoting distributed generation to improve energy access.

Global Distributed Energy Generation (DEG) System Market – Key Development

- On October 31, 2023, Zeno Power won a USD 7.5 million Pentagon Contract for an underwater radioisotopes power system.

- On January 5, 2023, Energy Vault Holdings Inc. and Pacific Gas & Electric Company announced that companies with partnering operate the largest green-hydrogen long-duration energy storage systems in the U.S.

- On April 13, 2023, Siemens and Humber Developed a Microgrid smart lab.

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

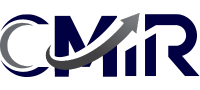

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

- We initiate in-depth discussions and consultations with our clients to gain a comprehensive understanding of their objectives. This involves actively listening to their needs, concerns, and aspirations regarding the research project.

- Through these interactions, we aim to uncover the underlying motivations driving their research requirements and the specific outcomes they hope to achieve.

Industry and Market Segment Analysis:

- We invest time and effort in comprehensively understanding our clients’ industry and market segment. This involves conducting thorough research into market trends, competitive dynamics, regulatory frameworks, and emerging opportunities or threats.

- By acquiring a deep understanding of the broader industry landscape, we can provide context-rich insights that resonate with our clients’ strategic objectives.

Target Audience Understanding:

- We analyze our clients’ target audience demographics, behaviors, preferences, and needs to align our research efforts with their consumer-centric objectives. This entails segmenting the audience based on various criteria such as age, gender, income level, geographic location, and psychographic factors.

- By understanding the nuances of the target audience, we can tailor our research methodologies to gather relevant data that illuminates consumer perceptions, attitudes, and purchase intent.

Identifying Challenges and Opportunities:

- We proactively identify the challenges and opportunities facing our clients within their respective industries. This involves conducting SWOT (Strengths, Weaknesses, Opportunities, Threats) analyses and competitive benchmarking exercises.

- By identifying potential obstacles and growth drivers, we can provide strategic recommendations that help our clients navigate complexities and capitalize on emerging opportunities effectively.

Grasping Specific Goals:

- We delve into the intricacies of our clients’ objectives to gain clarity on the specific goals they aim to accomplish through the research. This entails understanding their desired outcomes, such as market expansion, product development, or competitive analysis.

- By gaining a nuanced understanding of our clients’ goals, we can tailor our research approach to address their unique challenges and opportunities effectively.

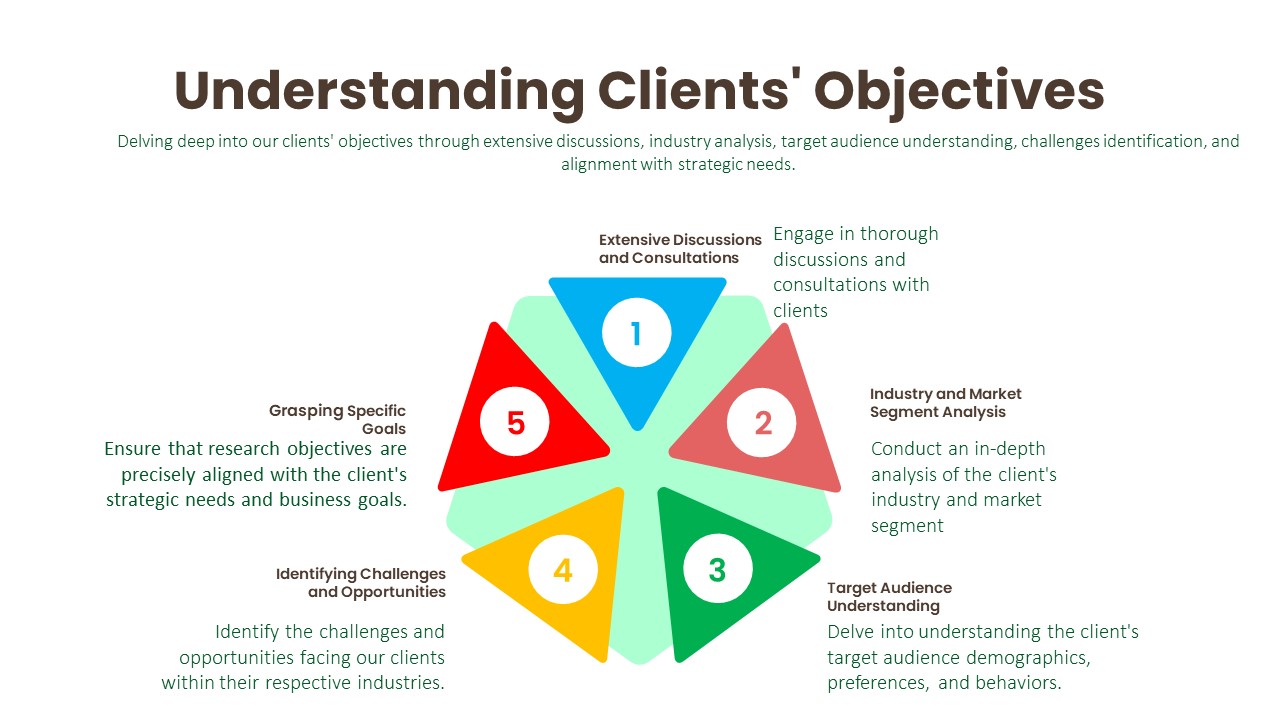

Data Collection:

Primary Research Process:

- Surveys: We design and administer surveys tailored to capture specific information relevant to our clients’ objectives. This may involve employing various survey methodologies, such as online, telephone, or face-to-face interviews, to reach target audiences effectively.

- Interviews: We conduct structured or semi-structured interviews with key stakeholders, industry experts, or target consumers to gather in-depth insights and perspectives on relevant topics. These interviews allow us to probe deeper into specific issues and uncover valuable qualitative data.

- Focus Groups: We organize focus group discussions with carefully selected participants to facilitate interactive discussions and gather collective opinions, attitudes, and preferences. This qualitative research method provides rich contextual insights into consumer behaviors and perceptions.

- Observations: We conduct observational research by directly observing consumer behaviors, interactions, and experiences in real-world settings. This method enables us to gather objective data on consumer actions and reactions without relying on self-reported information.

Secondary Research Process:

- Literature Review: We conduct comprehensive literature reviews to identify existing studies, academic articles, and industry reports relevant to the research topic. This helps us gain insights into previous research findings, theoretical frameworks, and best practices.

- Industry Reports: We analyze industry reports published by reputable trade associations (whitepapers, research studies, etc.), and government agencies (U.S. Census Bureau, Bureau of Labor Statistics, and Securities and Exchange Commission etc.) to obtain macro-level insights into market trends, competitive landscapes, and industry dynamics.

- Government Publications: We review government publications, such as economic reports, regulatory documents, and statistical databases, to gather relevant data on demographics, market size, consumer spending patterns, and regulatory frameworks.

- Online Databases: We leverage online databases, such as industry portals, and academic repositories (PubMed Central (PMC), ScienceDirect, SSRN (Social Science Research Network), Directory of Open Access Journals (DOAJ), NCBI, etc.), to access a wide range of secondary data sources, including market statistics, financial data, and industry analyses.

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

- Upon collecting the necessary data, we transition into the data analysis phase, where raw data is processed and transformed into actionable insights. This involves organizing, cleaning, and structuring the data to prepare it for analysis.

Utilization of Analytical Methods:

- Depending on the research objectives, we employ a diverse range of analytical methods to extract meaningful insights from the data. These methods include statistical analysis, trend analysis, regression analysis, and qualitative coding.

Statistical Analysis:

- Statistical tools are instrumental in uncovering patterns, correlations, and trends within the data. By applying statistical techniques such as descriptive statistics, hypothesis testing, and multivariate analysis, we can discern relationships and derive valuable insights.

Qualitative Analysis Techniques:

- In addition to quantitative analysis, we leverage qualitative analysis techniques to gain deeper insights from qualitative data sources such as interviews or open-ended survey responses. One such technique is thematic coding, which involves systematically categorizing and interpreting themes or patterns within qualitative data.

Integrity and Validity Maintenance:

- Throughout the analysis process, we maintain a steadfast commitment to upholding the integrity and validity of our findings. This entails rigorous adherence to established methodologies, transparency in data handling, and thorough validation of analytical outcomes.

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

- Data validation is the final phase of the research methodology, crucial for ensuring the reliability and credibility of the findings. It involves a systematic process of reviewing and verifying the collected data to detect any inconsistencies, errors, or biases.

Scrutiny of Collected Data:

- The validation process begins with a thorough scrutiny of the collected data to identify any discrepancies or anomalies. This entails comparing data points, checking for outliers, and verifying the accuracy of data entries against the original sources.

Validation Techniques:

- Various validation techniques are employed to ensure the accuracy and integrity of the data. These include cross-referencing data from multiple sources to corroborate findings, conducting validity checks on survey instruments to assess the reliability of responses, and seeking feedback from independent experts or peer reviewers to validate the interpretation of results.

Internal Quality Assurance Protocols:

- In addition to external validation measures, internal quality assurance protocols are implemented to further validate the accuracy of the analysis. This may involve conducting internal audits, peer reviews, or data validation checks to ensure that the research process adheres to established standards and guidelines.

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail