A prominent research firm, Cognizance Market Research added a cutting-edge industry report on the “Global Transplant Drug Monitoring Assay Market.” The report studies the current as well as past growth trends and opportunities for the market to gain valuable insights during the forecast period from 2022 to 2030.

Global Transplant Drug Monitoring Assay Market Analysis

According to cognizance market research, the Global Transplant Drug Monitoring Assay Market was valued at US$ 203.6 Million in 2022 and is anticipated to reach US$ 574.5 Million by the end of 2030 with a CAGR of 13.9% from 2023 to 2030.

What is the Global Transplant Drug Monitoring Assay Market?

The use of therapeutic drug monitoring (TDM), in transplant medicine, enables healthcare practitioners to keep immunosuppressant blood and plasma concentrations only within the recommended therapeutic range. Transplant drug monitoring reduces the risk of toxicity or rejection, as appropriate, by making sure that concentrations are neither excessively high nor too low.

To help with patient monitoring, reputable healthcare providers provide a range of immunosuppressant drug monitoring (ISD) tests, including those for methotrexate, cyclosporine, tacrolimus, and mycophenolate. Businesses in the transplant drug monitoring assay market are anticipated to benefit financially from increased medical spending, government reimbursement schemes, improving healthcare infrastructure, and rising global per capita income in the years to come.

The market is growing because of increased R&D spending, the prevalence of chronic liver and kidney illnesses, and the demand for organ transplants. Businesses in the global transplant medicine monitoring assay market should benefit greatly from the increased demand for point-of-care monitoring of therapeutic drugs and home-based therapeutic drug monitoring.

Transplant diagnostics are used to determine whether the donor and receiver of an organ are suitable before or after the transplant. The prevalence of diseases that can lead to organ failure, including pre-and post-transplant screening, is predicted to rise considerably because of the adoption of transplant diagnostics. Due to the diversity of benefits offered by these tests to determine the suitability of an organ transplant, the market has piqued the interest of medical professionals.

In the upcoming years, these elements are projected to fuel the market’s demand for transplant medication monitoring assays. The administration of medication is the first step in the transplant drug monitoring test. It involves choosing an initial dosage schedule that is appropriate for the patient’s clinical state, considering factors like age, body mass index, weight, organ function, and medication use.

Global Transplant Drug Monitoring Assay Market Outlook

The need for organ transplants and replacements is being driven by an increase in the prevalence of chronic diseases of the liver, heart, kidney, and pancreas as well as blood disorders such as leukemia and aplastic anemia. The market for transplant medication monitoring assays is anticipated to grow because of these. The Health Resources & Services Administration (HRSA) estimates that 42,800 or more transplants will be carried out worldwide in 2022.

The World Health Organization (WHO) estimates that the number of elderly people worldwide will be around 524 million in 2022 and will rise to 1,500 million by 2050. The elderly population has a direct impact on the need for organ transplants due to their higher risk of kidney and cardiac problems. The healthcare sector has reached new heights because of infrastructure and service modernization.

The market for equipment and consumables in the global transplant medication monitoring assay industry has been divided into several parts. In 2022, the equipment sector accounted for a sizable portion of the global market. Throughout the time of the forecast, the category is anticipated to expand quickly.

Segment Analysis:

The transplant drug monitoring assay market is segmented into technology, drug class, end-user, product, and geography to comprehensively analyze the global market for these assays.

The market for transplant medicine monitoring assays is categorized into chromatography-MS and immunoassays based on technology. Immunoassays are expected to dominate the market during the projection period due to their user-friendliness and the fact that they do not require specialized knowledge to use.

Transplant medication monitoring assays are further divided into immunosuppressant pharmaceuticals and antimetabolite drugs based on drug class. Medications with complex pharmacokinetics and a narrow therapeutic window, such as tacrolimus, methotrexate, and cyclosporin, are frequently examined. Tacrolimus is expected to lead the drug class market in 2022 and maintain its position throughout the forecast period.

The market for transplant drug monitoring assays is categorized into equipment and consumables based on the product. Consumables are further divided into clinical chemistry analyzers, immunoassay analyzers, and detectors for chromatography and MS. In 2022, a significant portion of the global market was attributed to the equipment sector, which is expected to grow rapidly during the projection period. Clinical chemistry analyzers and immunoassay analyzers enable mid-to-high-volume laboratories to operate more efficiently and profitably. Thermo Fisher Scientific’s introduction of “QMS Everolimus,” an advanced pharmaceutical analyzer used in medication monitoring for liver transplants, holds the EU’s CE mark and is expected to contribute to the growth of this sector.

The global transplant medicine monitoring assay market is segmented into hospital laboratories, commercial and private laboratories, and other sectors based on end-user. Since 2022, hospital laboratories have been the dominant end-user segment. Hospital laboratories increasingly offer assays for monitoring transfusion medication, and hospital pharmacists play a crucial role in overseeing these services. The rise in patient numbers is driving hospital laboratories to form alliances and partnerships, further advancing the industry.

Geographical Analysis

The global transplant drug monitoring assay market is segmented by geography into five main regions: North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

In 2022, North America accounted for a substantial market share of 35% of the global transplant medication monitoring assay market. North America’s dominance is attributed to advancements in medical science, surgical techniques, the effectiveness of immunosuppressive medications, and high success rates in organ transplants. The demand for organ transplantation is driven by the adoption of cutting-edge treatments, increased research and development activities, affordability, and a rising prevalence of chronic diseases like chronic renal diseases and cardiovascular diseases. These factors are likely to boost the demand for transplant medication monitoring assays in North America.

Europe and the Asia-Pacific region held the second and third-largest market shares, respectively. The Asia-Pacific region is experiencing growth in the transplant medication monitoring assay market due to a growing emphasis on organ donation and the presence of key players like Siemens Healthiness AG, Hologic, Inc., Danaher Corporation, and Bio-Rad Laboratories, Inc., particularly in countries like China, India, and South Korea. Europe also has a significant market share, driven by advancements in healthcare and a focus on organ transplantation.

The Latin American market is expected to grow at a faster pace compared to the Middle East and Africa. Both regions are seeing increasing awareness and emphasis on organ transplantation, but Latin America is expected to experience more rapid expansion in the transplant medication monitoring assay market.

In summary, while North America leads the global market for transplant medication monitoring assays, Europe, Asia Pacific, Latin America, and the Middle East & Africa also contribute significantly to the market’s growth. Factors such as advancements in medical science, increasing organ transplant rates, and the presence of key healthcare players in specific regions are driving market expansion in these areas.

The report offers the revenue of the global transplant drug monitoring assay market for the period 2020-2030, considering 2020 and 2021 as historical years, 2022 as the base year, and 2023 to 2030 as the forecast year. The report also provides the compound annual growth rate (CAGR) for the global transplant drug monitoring assay market for the forecast period. The global transplant drug monitoring assay market report provides insights and in-depth analysis into developments impacting enterprises and businesses on a regional and global level. The report covers the global transplant drug monitoring assay market performance in terms of revenue contribution from several segments and comprises a detailed analysis of key drivers, trends, restraints, and opportunities prompting revenue growth of the global transplant drug monitoring assay market.

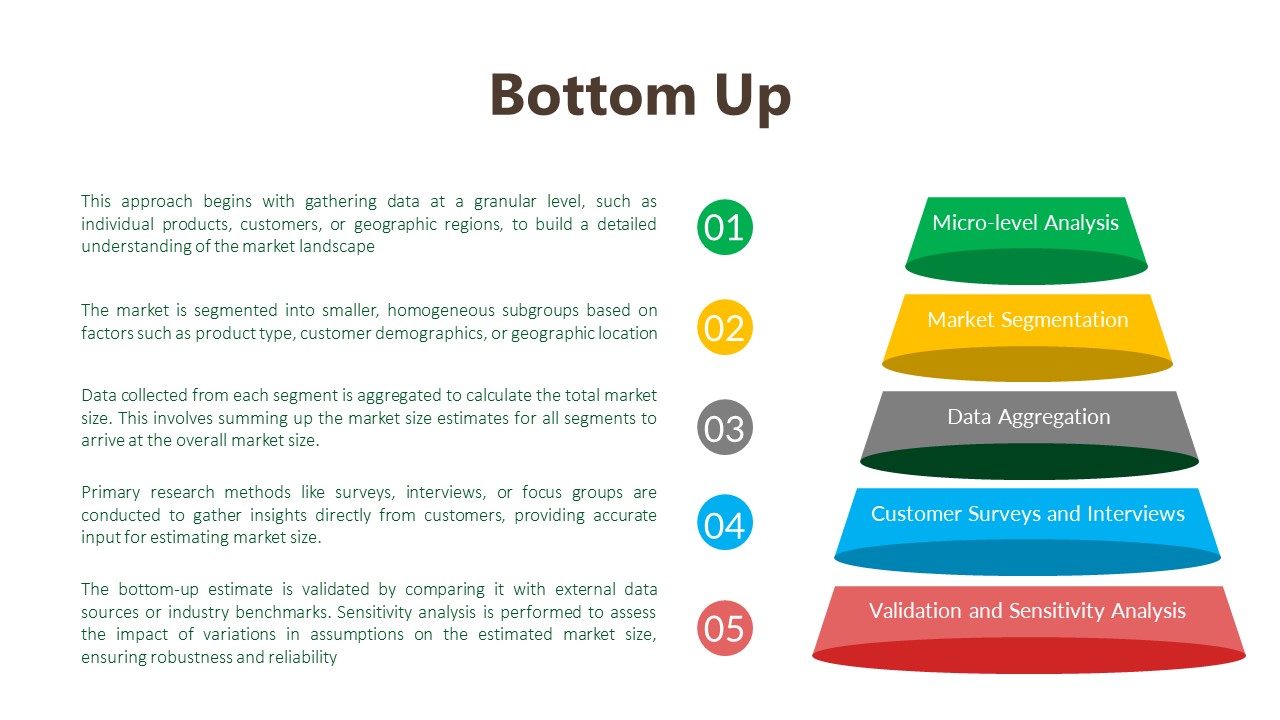

The report has been prepared after wide-ranging secondary and primary research. Secondary research included internet sources, numerical data from government organizations, trade associations, and websites. Analysts have also employed an amalgamation of bottom-up and top-down approaches to study numerous phenomena in the global transplant drug monitoring assay market. Secondary research involved a detailed analysis of significant players’ product portfolios. Literature reviews, press releases, annual reports, white papers, and relevant documents have also been studied to understand the global transplant drug monitoring assay market. Primary research involved a great extent of research efforts, wherein experts carried out interviews telephonic as well as questioner-based with industry experts and opinion-makers.

The report includes an executive summary, along with a growth pattern of different segments included in the scope of the study. The Y-o-Y analysis with elaborate market insights has been provided in the report to comprehend the Y-o-Y trends in the global transplant drug monitoring assay market. Additionally, the report focuses on altering competitive dynamics in the global market. These indices serve as valued tools for present market players as well as for companies interested in participating in the global transplant drug monitoring assay market. The subsequent section of the Transplant drug monitoring assay reports highlights the USPs, which include key industry events (product launch, research partnership, acquisition, etc.), technology advancements, pipeline analysis, prevalence data, and regulatory scenarios.

Global Transplant Drug Monitoring Assay Market Competitive Landscape

The “Global Transplant Drug Monitoring Assay Market” study report will provide valuable insight with an emphasis on the global market including some of the major players such as,

The report explores the competitive scenario of the global transplant drug monitoring assay market. Major players operating in the global transplant drug monitoring assay market have been identified and profiled for unique commercial attributes. Company overview (company description, product portfolio, geographic presence, employee strength, Key management, etc.), financials, SWOT analysis, recent developments, and key strategies are some of the features of companies profiled in the Global Transplant Drug Monitoring Assay Market report.

Segmentation:

Global Transplant Drug Monitoring Assay Market, by Technology

Global Transplant Drug Monitoring Assay Market, by Drug Class

Global Transplant Drug Monitoring Assay Market, by product

Global Transplant Drug Monitoring Assay Market, by end-user

Global Transplant Drug Monitoring Assay Market, by region

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

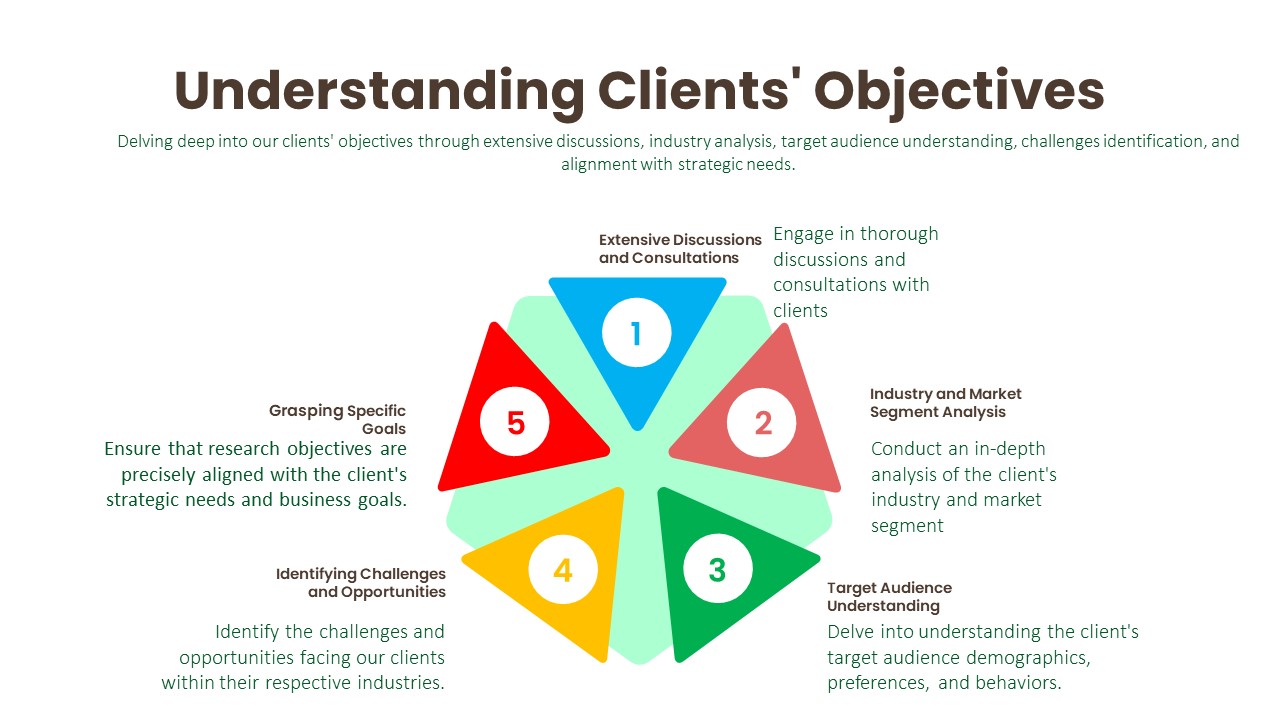

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

Industry and Market Segment Analysis:

Target Audience Understanding:

Identifying Challenges and Opportunities:

Grasping Specific Goals:

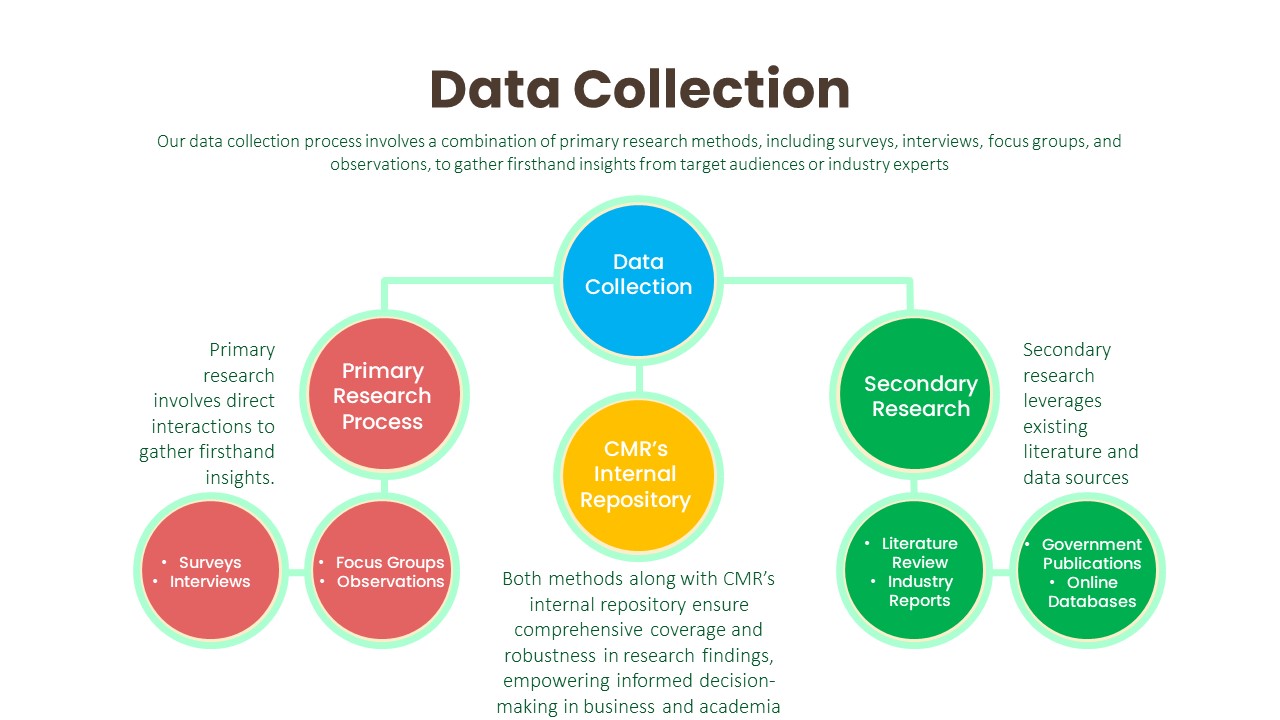

Data Collection:

Primary Research Process:

Secondary Research Process:

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

Utilization of Analytical Methods:

Statistical Analysis:

Qualitative Analysis Techniques:

Integrity and Validity Maintenance:

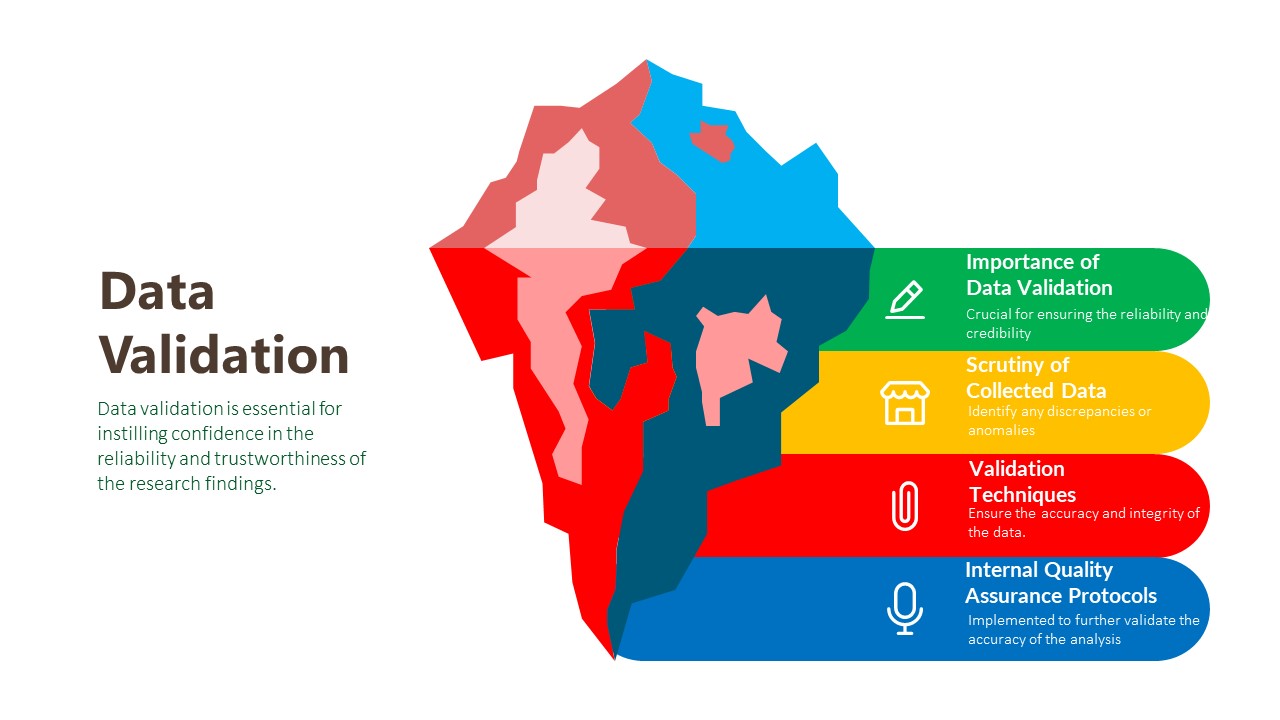

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

Scrutiny of Collected Data:

Validation Techniques:

Internal Quality Assurance Protocols:

Report Scope:

Attribute

Description

Market Size

US$ 574.5 Million (2030)

Compound Annual Growth Rate (CAGR)

13.90%

Base Year

2022

Forecast Period

2023-2030

Forecast Units

Value (US$ Million)

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

Geographies Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Countries Covered

U.S., Canada, Germany, U.K., France, Spain, Italy, Rest of Europe, Japan, China, India, Australia & New Zealand, South Korea, Rest of Asia Pacific, Brazil, Mexico, Rest of Latin America, GCC, South Africa, Rest of Middle East & Africa

Key Companies Profiled

Immucor Transplant Diagnostics Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Hoffman-La Roche Ltd. (Switzerland), GenDx (Netherlands), CareDx (U.S.)

Immucor Transplant Diagnostics Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Hoffman-La Roche Ltd. (Switzerland), GenDx (Netherlands), CareDx (U.S.)

Trend: Increased public awareness and disease diagnosis. Drivers: increase the prevalence of chronic illness. Opportunities: Challenges: high costs of the diagnostics instruments like PCR & NGS.

North America

Treatment

Investing in research and development activities, introducing innovative ways primarily, diversification of product portfolios, and acquisitions and mergers.

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail

Cognizance market research is continuously guiding customers around the globe towards strategies for transformational growth. Today, businesses have to innovate more than ever before, not just to survive, but to succeed in the future

© 2023 All rights Reserved. Cognizance Market Research