A prominent research firm, Cognizance Market Research added a cutting-edge industry report on the “Global Self-Sampling Blood Collection and Storage Devices Market”. The report studies the current as well as past growth trends and opportunities for the market to gain valuable insights during the forecast period from 2022 to 2030.

Global Self-Sampling Blood Collection and Storage Devices Market Analysis

According to cognizance market research, the Global Self-Sampling Blood Collection and Storage Devices Market was valued at US$ 156.40 Million in 2022 and is anticipated to reach US$ 605.09 Million by the end of 2030 with a CAGR of 18.5% from 2023 to 2030.

What are Self-Sampling Blood Collection and Storage Devices?

Blood collection stands as one of the most prevalent and essential components within diagnostic methodologies. This practice empowers medical professionals to exert efficient control, diagnose a spectrum of conditions, and offer effective treatments for a variety of ailments. The utility of blood tests extends to adeptly managing, diagnosing, and treating a myriad of serious and pressing illnesses, encompassing cardiovascular ailments, diabetes, and an extensive array of cancers.

Innovative advancements in technology have given rise to self-sampling blood collection and storage devices, marking a significant leap forward. This technology empowers individuals to collect their own blood samples, rendering the need to journey to a medical facility obsolete. Notably, this technique eliminates the use of needles, minimizing any risk of infection transmission and ensuring a virtually painless and less distressing blood withdrawal experience. The process of obtaining blood samples autonomously, coupled with the primary function of storage devices, facilitates patients in gathering and preserving their blood samples, subsequently destined for future testing. This holds particular importance in situations where access to clinical laboratories or hospitals is limited or non-existent.

The global landscape has witnessed a pronounced surge in demand for self-sampling blood collection and storage equipment across international markets. This surge is further fueled by the escalating prevalence of infectious diseases, the emergence of novel pathogens, and the increasing impact of severe lifestyle-related maladies. The universal requirement for blood collection is palpable, transcending geographical boundaries. Consequently, the market for self-sampling blood collection and storage devices is poised for substantial growth in the foreseeable future, mirroring the heightened demand.

In essence, the evolution of self-sampling blood collection and storage equipment is emblematic of the advancements in healthcare technology. As the world grapples with the complexities of diseases and health challenges, this sector is destined to witness significant expansion, driven by both necessity and innovation.

Global Self-Sampling Blood Collection and Storage Devices Market Outlook

The realm of blood disorders encompasses a range of conditions including anemia, bleeding disorders such as hemophilia and clotting issues, as well as blood cancers like leukemia, lymphoma, and myeloma. These ailments disrupt blood function and can involve various components of the blood. Genetics plays a role in many of these disorders, although they can also be triggered by other illnesses, medication side effects, and nutritional deficiencies. Hemophilia, a genetic bleeding disorder, impacts 1 in 5,000 male babies, with roughly 400 newborns diagnosed with hemophilia A annually. In the US, about 33,000 males are affected by this condition. The scope of blood malignancies and related diseases encompasses around 137 different forms. In Canada, for instance, approximately 22,340 people of all ages were diagnosed with blood cancer in a single year, highlighting the rising prevalence of such disorders.

Anemia, a condition involving low red blood cell count, accounted for 710,000 medical office visits in the United States, with women having a higher likelihood of developing it than men. However, after the age of 65, men become more susceptible. Anemia affects around 15% of women and 20% of men aged 80 and above.

The potential of self-blood collection for COVID-19 antibody testing to significantly reduce mortality and morbidity is noteworthy. This breakthrough could expand business opportunities for manufacturers of self-sampling blood collection and storage systems. Unlike capillary blood, venous blood is considered the highest-quality material for ELISA testing. Companies operating in the self-sampling blood collection and storage devices market are seizing this opportunity to intensify research and development in rapid lateral flow immunoassays (LFIAs). While LFIAs are time-consuming and require skilled personnel and significant investments, efforts to enhance their variable performance are underway to reduce costs and risks associated with inpatient sampling. Dried blood sample (DBS) kits, due to their simplicity, ease of use, and storage convenience, are suitable for at-home self-collection. However, these kits have limitations, such as elution steps that can dilute the sample up to 15 times, potentially lowering the analyte concentration beyond detectable levels by lab analyzers.

The global market for blood collection equipment is expected to expand due to the growing number of hospitals, surgical centers, and diagnostic labs worldwide. Rising awareness about the safety and practicality of modern blood collection technologies is set to drive market growth. Government initiatives to promote innovative medical technology are also contributing to industry expansion. However, the high cost and maintenance expenses of automated blood collection equipment constrain its adoption. Complex storage and transportation processes and the challenge of maintaining sterility pose significant difficulties. The need for stringent regulatory compliance further compounds distribution challenges. The demand for apheresis, a technique separating blood components, is projected to drive the blood collection equipment market, fueled by its therapeutic application in treating various disorders. The rise in chronic diseases like cancer and cardiovascular conditions also contributes to market growth. The increasing public awareness of the benefits of blood component separation further fuels expansion.

Segment Analysis:

The segmentation of the self-sampling blood collection and storage device market is based on several factors, including product type, collection system, applications, and end-users. This segmentation leads to distinct subcategories within the broader market of self-sampling blood collection and storage devices.

In the realm of self-sampling blood collection and storage equipment, there are two primary product categories: collection devices and other related products. Throughout the period from 2022 to 2030, it is projected that the collection devices segment will hold a dominant position in the global market for self-sampling blood collection and preservation devices. This dominance can be attributed to the growing demand for remote blood collection and testing.

The collection system segment within the self-sampling blood collection and storage market encompasses three main methods: arterial sampling, venepuncture sampling, and Fingerstick sampling. Arterial blood gases (ABG) assessment involves obtaining a sample from the radial artery, typically the recommended site for arterial puncture. Prior to drawing blood from the wrist, medical professionals must assess the pulse. Arterial blood can be obtained through a catheter inserted into an artery or by puncturing an artery using a needle and syringe. Venous blood collection involves accessing the superficial vein in the upper limb, which is close to the skin. This process is aided by using a tourniquet belt to aid blood flow. Conversely, capillary blood sampling, often referred to as fingerstick or fingerpick, entails a straightforward method of obtaining a small blood sample. This procedure is typically carried out on the fingertip or the tip of a finger..

The applications of self-sampling blood collection and storage devices encompass various areas, including clinical trials, therapeutic drug monitoring, population health studies, biomarker testing, and other epidemiological research domains. These applications collectively constitute the global market for self-sampling blood collection and storage equipment. During the forecast period, the segment centered around drug discovery and development is expected to witness a higher Compound Annual Growth Rate (CAGR).

The end-user segment of the self-sampling blood collection and storage devices market includes entities such as hospitals, outpatient surgery centers, nursing homes, diagnostic and pathology labs, academic and research institutes, blood banks, and other relevant facilities. Among these, hospitals, ambulatory surgery centers, and nursing homes are anticipated to generate the most revenue throughout the forecast period. The driving forces behind this segment’s growth encompass the expansion of hospital pharmacies (particularly notable during the COVID-19 pandemic), non-profit organization’s efforts to enhance the healthcare system, and advancements in sterile blood collection kits.

Geographical Analysis:

From a geographical perspective, the global market for self-sampling blood collection and storage devices is divided into five main regions: North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Looking ahead, North America is expected to secure a substantial portion of the self-sampling blood collection and storage equipment market during the projected timeframe. This region’s market is poised for notable growth over the forecast period due to various factors, including a well-established healthcare system, economic stability, and heightened public awareness. The years from 2022 to 2031 are projected to witness rapid expansion in North America’s market presence. Among the different regional markets, North America held the largest revenue share for self-sampling blood collection and storage devices in 2022. This achievement can be attributed to strong medical reimbursement policies related to these devices, which significantly contribute to revenue growth in the North American market. Additionally, substantial government investments in research aimed at developing treatments for rare diseases and ongoing technological advancements within the healthcare sector further bolster market progress.

In the European region, the market for self-sampling blood collection and storage devices is expected to experience robust revenue growth throughout the forecast period. This projection is grounded in the growing public awareness about the importance of regular testing and medical check-ups for maintaining a healthy lifestyle.

Meanwhile, the Asia Pacific region is set to exhibit the highest Compound Annual Growth Rate (CAGR) in the self-sampling blood collection and storage devices market during the projected period. Several key factors drive this growth, including rapid urbanization, a rise in the prevalence of chronic diseases—particularly notable in countries like India, China, Malaysia, and Indonesia—and substantial governmental investments in healthcare infrastructure. Favorable regulations and government initiatives aimed at supporting healthcare startups further expedite market expansion within this region.

The report offers the revenue of the global self-sampling blood collection and storage devices market for the period 2022-2030, considering 2020 & 2021 as historical years, 2022 as the base year, and 2023 to 2030 as the forecast year. The report also provides the compound annual growth rate (CAGR) for the global self-sampling blood collection and storage devices market for the forecast period. The global self-sampling blood collection and storage devices market report provides insights and in-depth analysis into developments impacting enterprises and businesses on a regional and global level. The report covers the global self-sampling blood collection and storage devices market performance in terms of revenue contribution from several segments and comprises a detailed analysis of key drivers, trends, restraints, and opportunities prompting revenue growth of the Self-Sampling Blood Collection and Storage Devices market.

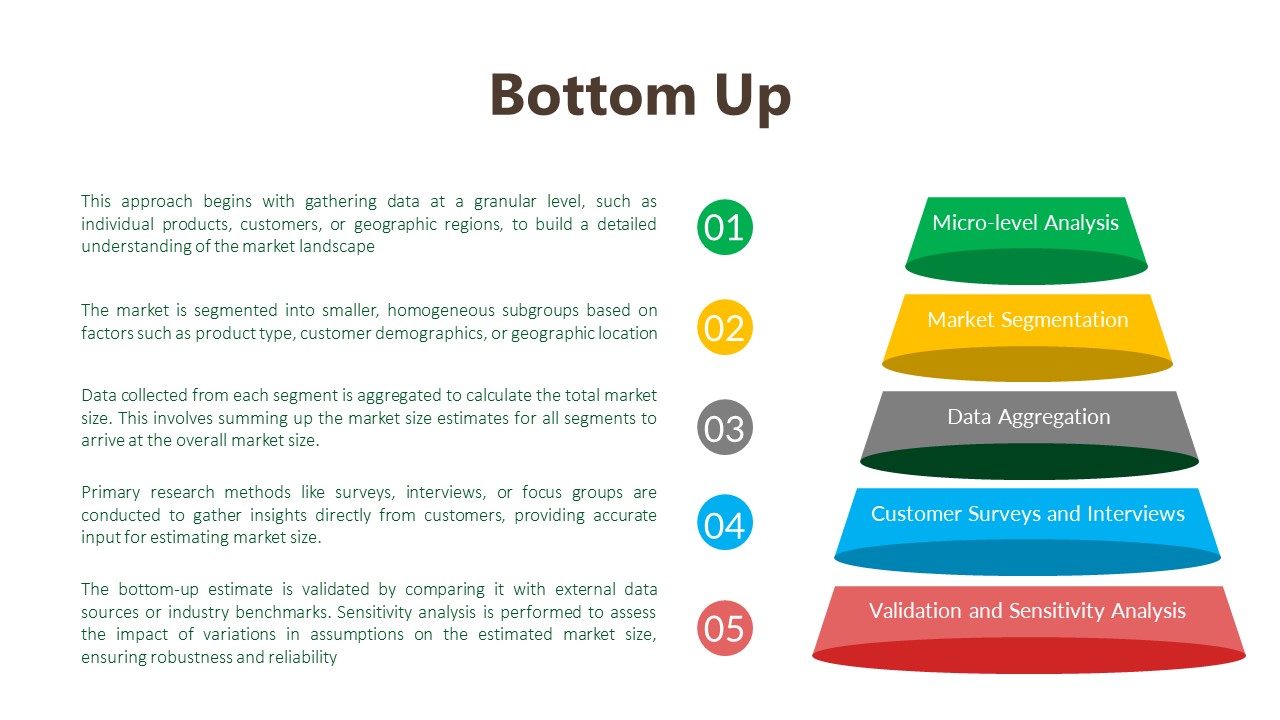

The report has been prepared after wide-ranging secondary and primary research. Secondary research included internet sources, numerical data from government organizations, trade associations, and websites. Analysts have also employed an amalgamation of bottom-up and top-down approaches to study numerous phenomena in the Self-Sampling Blood Collection and Storage Devices market. Secondary research involved a detailed analysis of significant players’ product portfolios. Literature reviews, press releases, annual reports, white papers, and relevant documents have been also studied to understand the Self-Sampling Blood Collection and Storage Devices market. Primary research involved a great extent of research efforts, wherein experts carried out interviews telephonic as well as questioner-based with industry experts and opinion-makers.

The report includes an executive summary, along with a growth pattern of different segments included in the scope of the study. The Y-o-Y analysis with elaborate market insights has been provided in the report to comprehend the Y-o-Y trends in the global self-sampling blood collection and storage devices market. Additionally, the report focuses on altering competitive dynamics in the global market. These indices serve as valued tools for present market players as well as for companies interested in participating in the self-sampling blood collection and storage devices market. The subsequent section of the global self-sampling blood collection and storage devices market report highlights the USPs, which include key industry events (product launch, research partnership, acquisition, etc.), technology advancements, pipeline analysis, prevalence data, and regulatory scenarios.

Global Self-Sampling Blood Collection and Storage Devices Market Competitive Landscape

The “global self-sampling blood collection and storage devices market study report will provide valuable insight with an emphasis on the global market including some of the major players such as:

The competitive landscape of the global self-sampling blood collection and storage devices market is examined in the report. The market’s major players in the management of the global self-sampling blood collection and storage devices market have been identified and profiled for their distinctive commercial characteristics. Companies profiled in the global self-sampling blood collection and storage devices market research have an overview (business description, product portfolio, regional presence, employee strength, key management, etc.), financials, SWOT analysis, recent advancements, and important strategies.

Segmentation:

Global Self-Sampling Blood Collection and Storage Devices, by Product Type

Global Self-Sampling Blood Collection and Storage Devices Market, by Collection Type

Global Self-Sampling Blood Collection and Storage Devices Market, by Application

Global Self-Sampling Blood Collection and Storage Devices Market, by Region

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

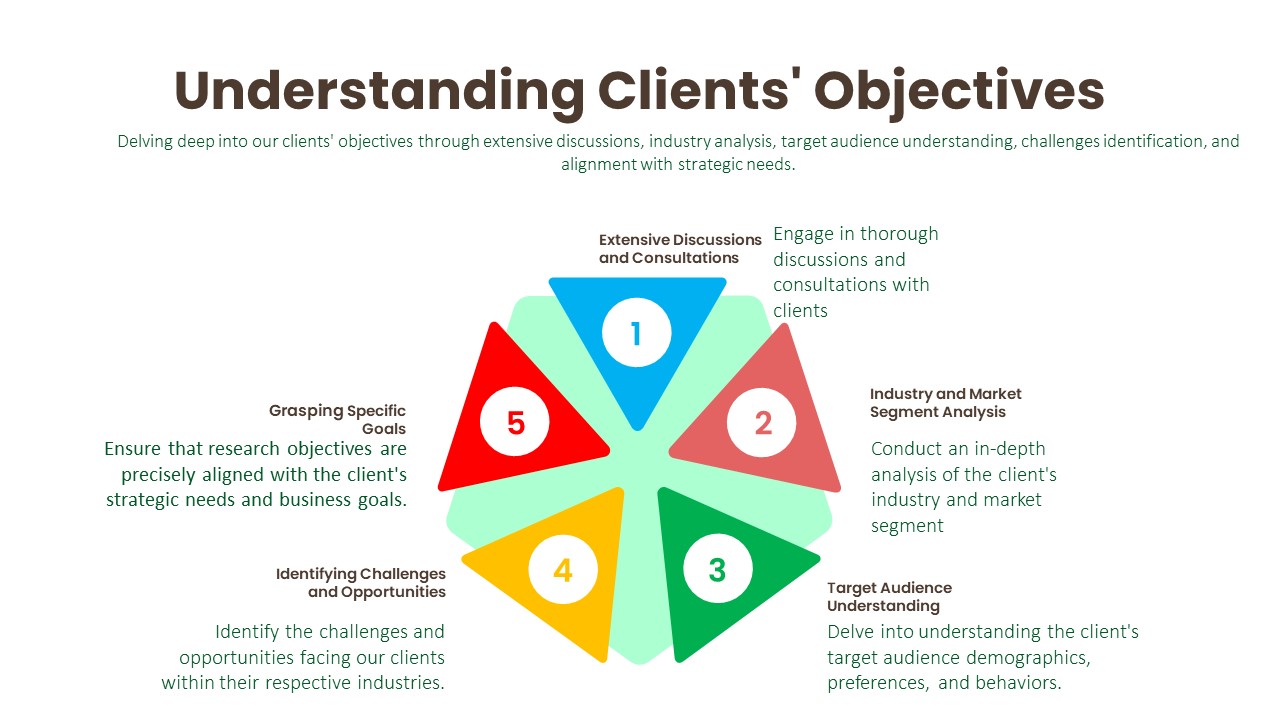

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

Industry and Market Segment Analysis:

Target Audience Understanding:

Identifying Challenges and Opportunities:

Grasping Specific Goals:

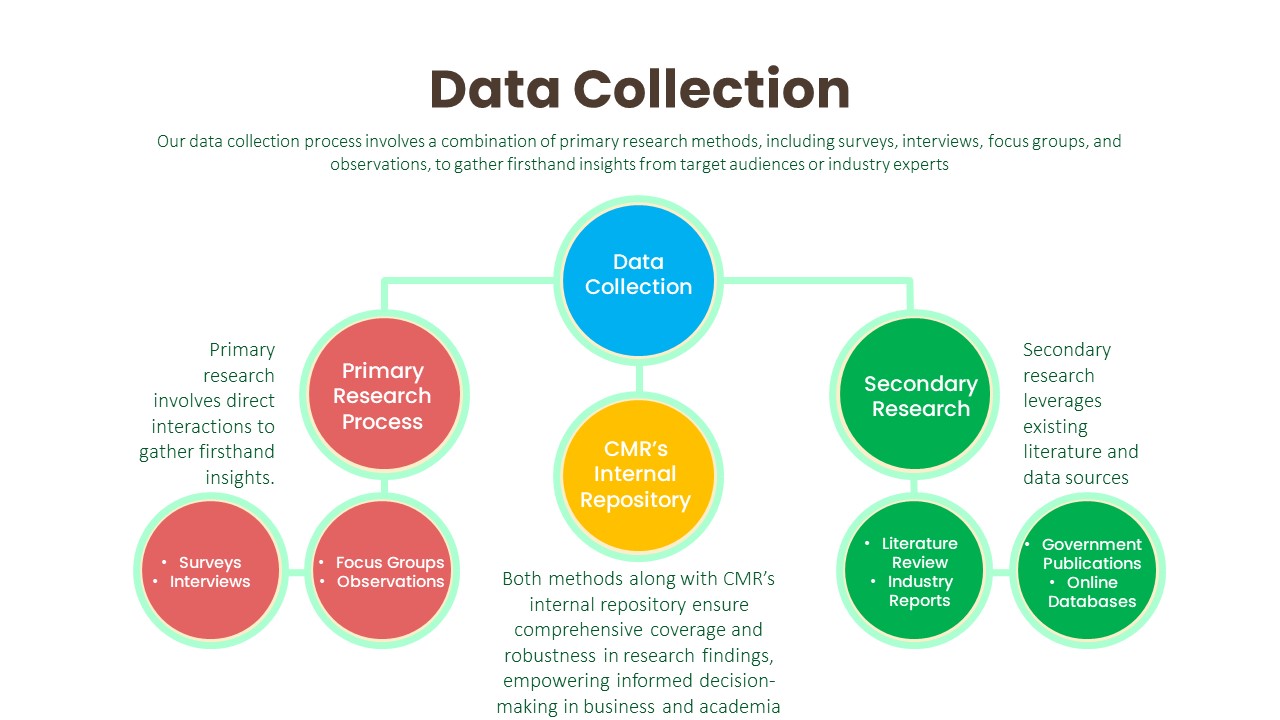

Data Collection:

Primary Research Process:

Secondary Research Process:

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

Utilization of Analytical Methods:

Statistical Analysis:

Qualitative Analysis Techniques:

Integrity and Validity Maintenance:

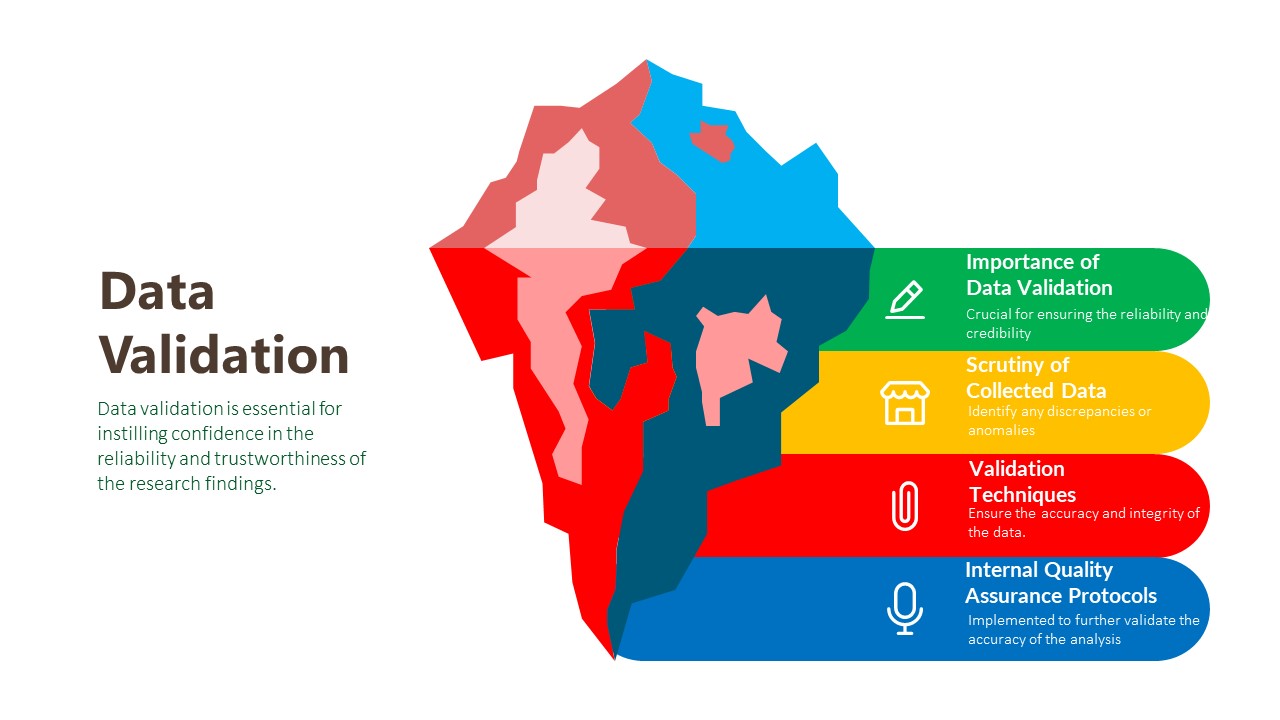

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

Scrutiny of Collected Data:

Validation Techniques:

Internal Quality Assurance Protocols:

Report Scope:

Attribute

Description

Market Size

US$ 605.09 Million (2030)

Compound Annual Growth Rate (CAGR)

18.50%

Base Year

2022

Forecast Period

2023-2030

Forecast Units

Value (US$ Million)

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

Geographies Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Countries Covered

U.S., Canada, Germany, U.K., France, Spain, Italy, Rest of Europe, Japan, China, India, Australia & New Zealand, South Korea, Rest of Asia Pacific, Brazil, Mexico, Rest of Latin America, GCC, South Africa, Rest of Middle East & Africa

Key Companies Profiled

Neoteryx, LLC., DBS System SA, PanoHealth, Tasso, Inc., Seventh Sense Biosystems, LAMEDITECH, Captain, Spot On Sciences, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop

Neoteryx, LLC., DBS System SA, PanoHealth, Tasso, Inc., Seventh Sense Biosystems, etc.

Trend: rising awareness in people for early diagnosis, funding provided through government initiatives, etc.,

Drivers: Increasing number of hospitals, surgical centers, and diagnostic laboratories, growing need for effective & powerful medication, etc.,

Opportunities: Increasing demand for apheresis, Technological advancement in research laboratories, etc., challenges: Increasing complexities of storage and shipping, etc.

North America

Collection device segment (Product)

Acquisition & merges, the launch of a new product, collaborative agreement, quality improvement, etc.

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail

Cognizance market research is continuously guiding customers around the globe towards strategies for transformational growth. Today, businesses have to innovate more than ever before, not just to survive, but to succeed in the future

© 2023 All rights Reserved. Cognizance Market Research