Global Pharmaceutical Excipients Market “By Type (Inorganic Chemicals {Calcium Phosphates, Calcium Carbonate, Calcium Sulphate, Halites, Metallic Oxides and Other Inorganic Chemicals}, Organic Chemicals {Carbohydrates, Petrochemicals, Oleochemicals, Proteins And Other Organic Chemicals} and Other Chemicals); By Functionality (Fillers & Diluents, Suspending & Viscosity Agents, Coating Agents, Binders, Flavouring Agents & Sweeteners, Disintegrants, Colorants, Lubricants & Glidants, Preservatives, Buffers, Sorbents, Emollients, Chelating Agents, Antifoaming Agents, Emulsifying Agents and Others); By Formulation (Topical Formulation, Oral Formulation, Parenteral Formulation and Others)” - Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2030

- Category: Pharmaceuticals and Biotechnology

- Report ID: CMR10381

- Published Date:

A prominent research firm, Cognizance Market Research added a cutting-edge industry report on “Global Pharmaceutical Excipients Market”. The report studies the current as well as past growth trends and opportunities for the market to gain valuable insights during the forecast period from 2023 to 2030.

Global Pharmaceutical Excipients Market Analysis

According to cognizance market research, the global pharmaceutical excipients market was valued at US$ 8,765.4 Million in 2022 and is anticipated to reach US$ 13,346.0 Million by the end of 2030 with a CAGR of 5.4% from 2023 to 2030.

What are Pharmaceutical Excipients?

Pharmaceutical excipients are inert substances that are used with active pharmaceutical ingredients (API) in medication formulations to simplify manufacturing, enhance drug distribution, and improve the stability, safety, and efficacy of the finished pharmaceutical product. A wide variety of compounds, including fillers, binders, lubricants, disintegrants, colouring agents, preservatives, and flavouring agents, can be used as excipients. The safety, efficacy, and compatibility of these ingredients with the API and other excipients in the formulation are carefully considered and tested. Excipient selection and use are crucial components of the development and formulation of drugs since they can significantly affect the performance and properties of a medicinal product.

Excipients used in pharmaceutical formulation and development are important. These substances contain ingredients besides the drug or prodrug that is pharmacologically active. Drug distribution to the target site is facilitated by pharmaceutical excipients. These molecules assimilate and improve the medicine’s effectiveness while preventing the drug from being released too early. Some excipients used in pharmaceuticals encourage drug integration, which increases drug absorption in the bloodstream.

Pharmaceutical Excipients Market Outlook

In the global pharmaceutical excipients market report, the market outlook segment mainly includes important dynamics of the market which include drivers, restraints, opportunities and challenges tackled by the industry. Opportunities and challenges are extrinsic factors whereas, drivers and restraints are intrinsic factors of the market.

The price of a generic drug is typically 60–70% less expensive than that of a brand-name drug two–three years after the loss of exclusivity. Generic drugs, like brand-name drugs, need competition in the generic drug market before costs may be reduced. The use of generic medications has dramatically expanded nationwide in recent years. One of the main factors anticipated to fuel the expansion of the pharmaceutical sector is the availability of affordable alternatives to name-brand medications. The global pharmaceutical excipients market is thus anticipated to increase as a result of rising generic medicine demand and rising output. Additionally, because generic medications are less expensive, they are used more frequently.

Excipients play a minor role in the worldwide pharmaceutical industry’s rising development. The demand for excipients has increased in recent years as a result of rising generic medicine demand. Additionally, the prevalence of chronic diseases has dramatically increased. Excipients are frequently employed in the preparation of pharmaceuticals to increase the volume of solid formulations, offer long-term stability, and improve drug absorption. Additionally, it enhances the product’s general functionality or safety while usage or storage. The global pharmaceutical excipients market is thus anticipated to be driven by the extensive use of excipients in medication formulation and its applications.

Since mixing excipients has led to unfavourable patient outcomes, authorities and medication makers now prioritise controlling the production and distribution of excipients. Furthermore, improved control of the supply and quality of pharmaceutical excipients has become more crucial in the context of in vivo activity as a result of the development of new excipients and delivery systems. Excipient suppliers must satisfy the pharmaceutical industry’s quality standards due to the excipients’ crucial role in pharmaceutical dosage forms, and the pharmaceutical industry as a whole must work to ensure the product’s safety. The supply chain’s use or storage integrity. Therefore, it is anticipated that the expansion of the worldwide pharmaceutical excipients market will be constrained by the increasing regulatory requirements for the licencing of pharmaceuticals and excipients.

Pharmaceutical excipients in medication formulations rarely cause adverse effects, but when they do, the risk of toxicity is elevated, especially in neonates and young children. Among the common pharmaceutical excipients with known negative effects include Methyl and Propyl para-hydroxybenzoate (Parabens), Benzyl Alcohol, Sodium Benzoate, Benzoic Acid, and Propylene Glycol, among others. Excipients used in pharmaceutical products are not necessarily the neutral compounds we assume. They are either intolerant to a specific person or, if properly screened, they have the potential to chemically alter the drug, resulting in the side effect. This could have an impact on excipient demand and is anticipated to present a challenge for the worldwide excipients market for pharmaceuticals.

Segment Analysis:

The pharmaceutical excipients market has been segmented into type, functionality, formulation and geography.

Based on type, the market for pharmaceutical excipients is classified into organic chemicals, inorganic chemicals and other chemicals. The organic chemicals segment has been further categorised into five categories viz. carbohydrates, petrochemicals, oleochemicals, proteins and other organic chemicals. Because more organic compounds are being used in various pharmaceutical formulations, the organic segment is predicted to dominate the market.

Based on functionality, the pharmaceutical excipients market has been bifurcated into fillers & diluents, suspending & viscosity agents, coating agents, binders, flavouring agents & sweeteners, disintegrants, colourants, lubricants & glidants, preservatives, buffers, sorbent, emollients, chelating agents, antifoaming agents, emulsifying agents and others. Due to the rising demand for pharmaceutical and biopharmaceutical drugs as well as the introduction of new products, the binders category is anticipated to have considerable expansion throughout the forecast period.

Based on formulation, the pharmaceutical excipients market is segmented into topical formulations. oral formulations. parenteral formulations and others. The largest market share belongs to oral formulation. Oral drug administration keeps the drugs’ chemical and physical stability while assisting the manufacturer with packaging and transportation.

Geographical Analysis:

Based on geography the global pharmaceutical excipients market has been segmented into five main regions namely, North America, Asia Pacific, Europe, Latin America, and Middle East & Africa.

Europe held the largest market share for pharmaceutical excipients, and it is anticipated that it would continue to dominate the market during the projected period. Due to the imminent expiration of drug patents, many European nations are concentrating on the generics industry. As a result, considerable growth rates in European nations like Germany, the United Kingdom, France, and others are predicted to occur throughout the projection period. This is projected to increase demand for pharmaceutical excipients in the region. Additionally, it is projected that the market for generic medications in these nations will be driven by the expanding government initiatives for lowering the prices of the drugs on the market. The aforementioned elements are projected to enhance the demand for new excipients, which will help the pharmaceutical excipients market in Europe grow along with increased investments in the development of biologics and innovative dosage forms.

Due to the rising demand for potent oral medications for the treatment of chronic disorders, the North American market is anticipated to expand at a substantial rate over the course of the projected period. However, the Asia-Pacific region is predicted to have the highest CAGR due to the availability of cheap labour and low-cost raw resources.

The report offers the revenue of the global pharmaceutical excipients market for the period 2020-2030, considering 2020 & 2021 as a historical years, 2022 as the base year and 2023 to 2030 as the forecast year. The report also provides the compound annual growth rate (CAGR) for the global pharmaceutical excipients market for the forecast period. The global pharmaceutical excipients market report provides insights and in-depth analysis into developments impacting enterprises and businesses on a regional and global level. The report covers the global pharmaceutical excipients market performance in terms of revenue contribution from several segments and comprises a detailed analysis of key drivers, trends, restraints, and opportunities prompting revenue growth of the pharmaceutical excipients market.

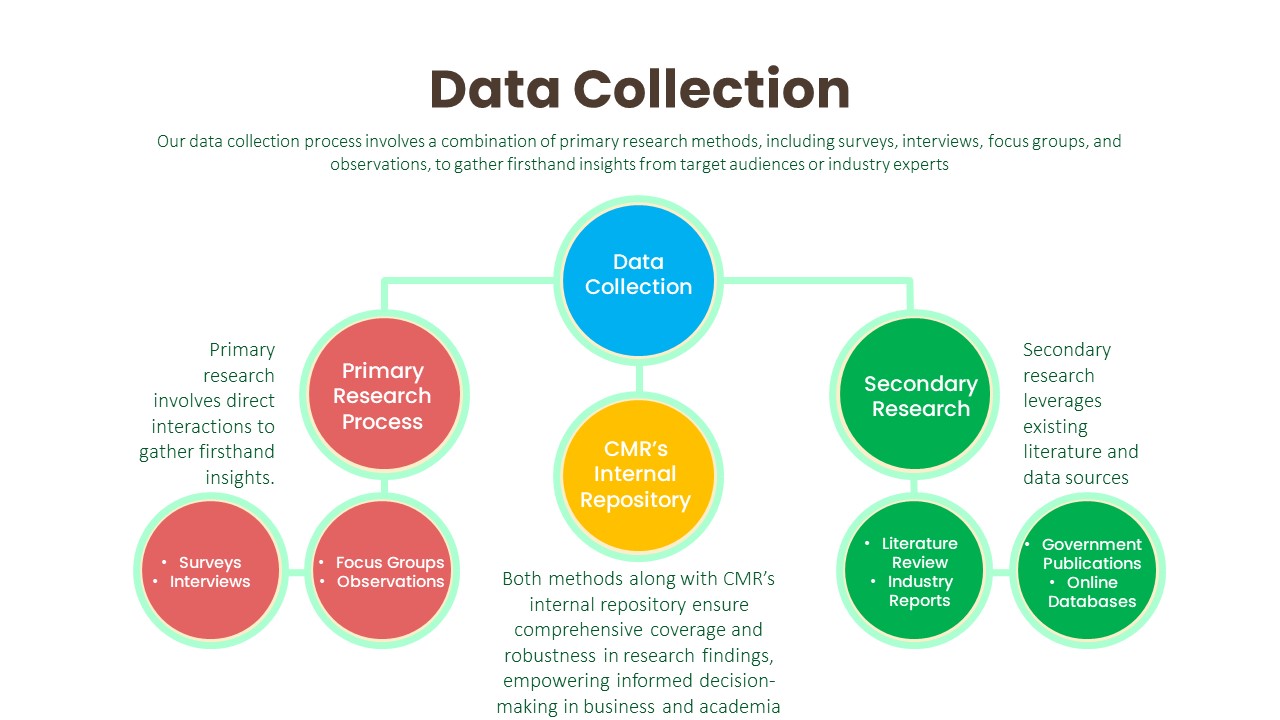

The report has been prepared after wide-ranging secondary and primary research. Secondary research included internet sources, numerical data from government organizations, trade associations, and websites. Analysts have also employed an amalgamation of bottom-up and top-down approaches to study numerous phenomena in the global pharmaceutical excipients market. Secondary research involved a detailed analysis of significant players’ product portfolios. Literature reviews, press releases, annual reports, white papers, and relevant documents have been also studied to understand the global pharmaceutical excipients market. Primary research involved a great extent of research efforts, wherein experts carried out interviews telephonic as well as questioner-based with industry experts and opinion-makers.

The report includes an executive summary, along with a growth pattern of different segments included in the scope of the study. The Y-o-Y analysis with elaborate market insights has been provided in the report to comprehend the Y-o-Y trends in the global pharmaceutical excipients market. Additionally, the report focuses on altering competitive dynamics in the global market. These indices serve as valued tools for present market players as well as for companies interested in participating in the pharmaceutical excipients market. The subsequent section of the global pharmaceutical excipients report highlights the USPs, which include key industry events (product launch, research partnership, acquisition, etc.), technology advancements, pipeline analysis, prevalence data, and regulatory scenario.

Global Pharmaceutical Excipients Market Competitive Landscape

The “Global Pharmaceutical Excipients Market” study report will provide valuable insight with an emphasis on the global market including some of the significant players such as-

- Archer Daniels Midland Company

- Associated British Foods

- Avantor, Inc.

- BASF SE

- BENEO

- Cargill

- Chemie Trade

- Colorcon

- Croda International Plc

- DFE Pharma

- Dow Chemical Company

- DuPont

- Evonik Industries AG

- Kerry Group plc.

- MEGGLE GmbH & Co. KG

- Omya AG

- Peter Greven GmbH & Co. KG

- Pfanstiehl

- Roquette Frères.

- The Lubrizol Corporation

Key developments in the pharmaceutical excipients market-

- The acryl-EZE II film coating line, introduced by Colorcon in 2020, expands the pH range that its enteric coatings can withstand.

- A titanium oxide-based coating for tablets called Aquarius Nutra TF was introduced by Ashland in 2019 for the European market.

- Roquette and Thermo Fisher entered into a contract in 2018 giving Thermo the authority to sell Roquette products in the US and Canada. Roquette will have more market access as a result of this.

The report explores the competitive scenario of the global pharmaceutical excipients market. Major players operating in the pharmaceutical excipients market have been identified and profiled for unique commercial attributes. Company overview (company description, product portfolio, geographic presence, employee strength, Key management, etc.), financials, SWOT analysis, recent developments, and key strategies are some of the features of companies profiled in the pharmaceutical excipients market report.

Segmentation:

Global Pharmaceutical Excipients Market, By Type

- Inorganic Chemicals

- Calcium Phosphates

- Calcium Carbonate

- Calcium Sulphate

- Halites

- Metallic Oxides

- Other Inorganic Chemicals

- Organic Chemicals

- Carbohydrates

- Sugar

- Starch

- Cellulose

- Petrochemicals

- Glycols

- Povidones Polymers

- Mineral Hydrocarbons

- Acrylic Polymers

- Others

- Oleochemicals

- Fatty Alcohols

- Metal Stearates

- Glycerin

- Others

- Proteins

- Other Organic Chemicals

- Carbohydrates

- Other Chemicals

Global Pharmaceutical Excipients Market, by Functionality

- Fillers & Diluents

- Suspending & Viscosity Agents

- Coating Agents

- Binders

- Flavouring Agents & Sweeteners

- Disintegrants

- Colorants

- Lubricants & Glidants

- Preservatives

- Buffers

- Sorbents

- Emollients

- Chelating Agents

- Antifoaming Agents

- Emulsifying Agents

- Others

Global Pharmaceutical Excipients Market, by Formulation

- Topical Formulations

- Oral Formulations

- Parenteral Formulations

- Others

Global Pharmaceutical Excipients Market, by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Research Methodology: Aspects

Market research is a crucial tool for organizations aiming to navigate the dynamic landscape of customer preferences, business trends, and competitive landscapes. At Cognizance Market Research, acknowledging the importance of robust research methodologies is vital to delivering actionable insights to our clientele. The significance of such methodologies lies in their capability to offer clarity in complexity, guiding strategic management with realistic evidence rather than speculation. Our clientele seek insights that excel superficial observations, reaching deep into the details of consumer behaviours, market dynamics, and evolving opportunities. These insights serve as the basis upon which businesses craft tailored approaches, optimize product offerings, and gain a competitive edge in an ever-growing marketplace.

The frequency of information updates is a cornerstone of our commitment to providing timely, relevant, and accurate insights. Cognizance Market Research adheres to a rigorous schedule of data collection, analysis, and distribution to ensure that our reports reflect the most current market realities. This proactive approach enables our clients to stay ahead of the curve, capitalize on emerging trends, and mitigate risks associated with outdated information.

Our research process is characterized by meticulous attention to detail and methodological rigor. It begins with a comprehensive understanding of client objectives, industry dynamics, and research scope. Leveraging a combination of primary and secondary research methodologies, we gather data from diverse sources including surveys, interviews, industry reports, and proprietary databases. Rigorous data analysis techniques are then employed to derive meaningful insights, identify patterns, and uncover actionable recommendations. Throughout the process, we remain vigilant in upholding the highest standards of data integrity, ensuring that our findings are robust, reliable, and actionable.

Key phases involved in in our research process are mentioned below:

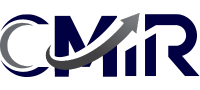

Understanding Clients’ Objectives:

Extensive Discussions and Consultations:

- We initiate in-depth discussions and consultations with our clients to gain a comprehensive understanding of their objectives. This involves actively listening to their needs, concerns, and aspirations regarding the research project.

- Through these interactions, we aim to uncover the underlying motivations driving their research requirements and the specific outcomes they hope to achieve.

Industry and Market Segment Analysis:

- We invest time and effort in comprehensively understanding our clients’ industry and market segment. This involves conducting thorough research into market trends, competitive dynamics, regulatory frameworks, and emerging opportunities or threats.

- By acquiring a deep understanding of the broader industry landscape, we can provide context-rich insights that resonate with our clients’ strategic objectives.

Target Audience Understanding:

- We analyze our clients’ target audience demographics, behaviors, preferences, and needs to align our research efforts with their consumer-centric objectives. This entails segmenting the audience based on various criteria such as age, gender, income level, geographic location, and psychographic factors.

- By understanding the nuances of the target audience, we can tailor our research methodologies to gather relevant data that illuminates consumer perceptions, attitudes, and purchase intent.

Identifying Challenges and Opportunities:

- We proactively identify the challenges and opportunities facing our clients within their respective industries. This involves conducting SWOT (Strengths, Weaknesses, Opportunities, Threats) analyses and competitive benchmarking exercises.

- By identifying potential obstacles and growth drivers, we can provide strategic recommendations that help our clients navigate complexities and capitalize on emerging opportunities effectively.

Grasping Specific Goals:

- We delve into the intricacies of our clients’ objectives to gain clarity on the specific goals they aim to accomplish through the research. This entails understanding their desired outcomes, such as market expansion, product development, or competitive analysis.

- By gaining a nuanced understanding of our clients’ goals, we can tailor our research approach to address their unique challenges and opportunities effectively.

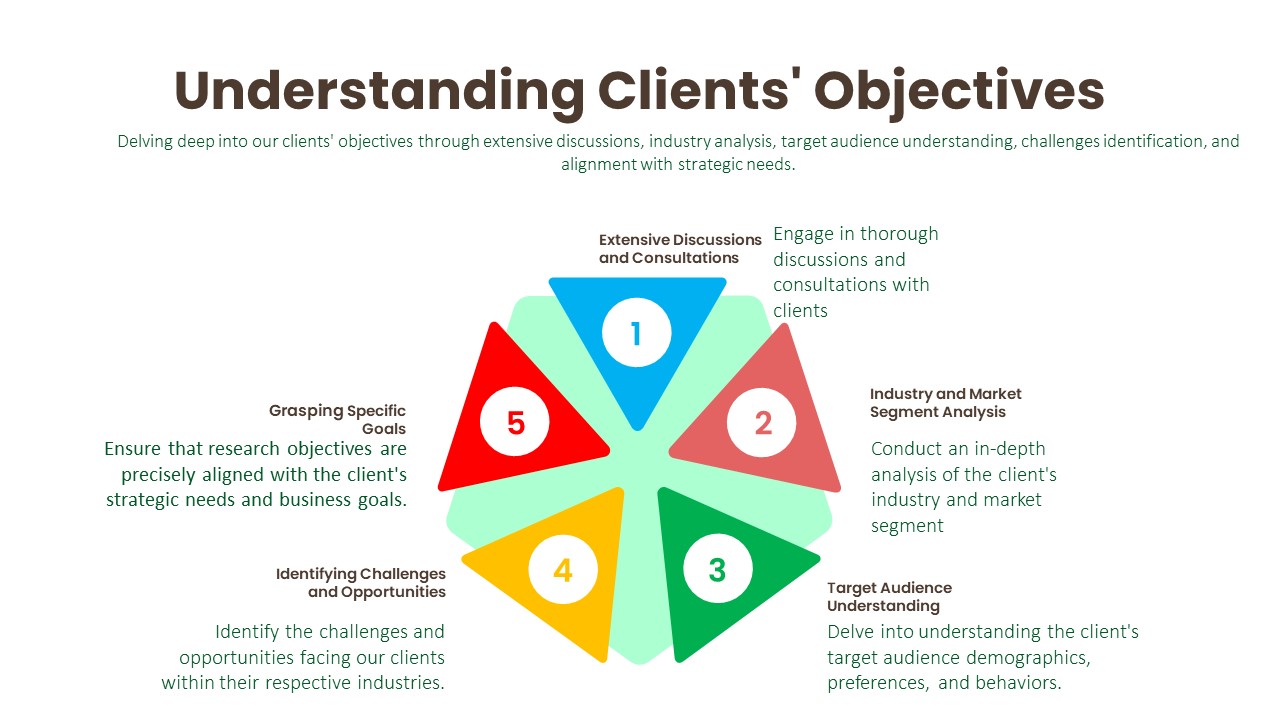

Data Collection:

Primary Research Process:

- Surveys: We design and administer surveys tailored to capture specific information relevant to our clients’ objectives. This may involve employing various survey methodologies, such as online, telephone, or face-to-face interviews, to reach target audiences effectively.

- Interviews: We conduct structured or semi-structured interviews with key stakeholders, industry experts, or target consumers to gather in-depth insights and perspectives on relevant topics. These interviews allow us to probe deeper into specific issues and uncover valuable qualitative data.

- Focus Groups: We organize focus group discussions with carefully selected participants to facilitate interactive discussions and gather collective opinions, attitudes, and preferences. This qualitative research method provides rich contextual insights into consumer behaviors and perceptions.

- Observations: We conduct observational research by directly observing consumer behaviors, interactions, and experiences in real-world settings. This method enables us to gather objective data on consumer actions and reactions without relying on self-reported information.

Secondary Research Process:

- Literature Review: We conduct comprehensive literature reviews to identify existing studies, academic articles, and industry reports relevant to the research topic. This helps us gain insights into previous research findings, theoretical frameworks, and best practices.

- Industry Reports: We analyze industry reports published by reputable trade associations (whitepapers, research studies, etc.), and government agencies (U.S. Census Bureau, Bureau of Labor Statistics, and Securities and Exchange Commission etc.) to obtain macro-level insights into market trends, competitive landscapes, and industry dynamics.

- Government Publications: We review government publications, such as economic reports, regulatory documents, and statistical databases, to gather relevant data on demographics, market size, consumer spending patterns, and regulatory frameworks.

- Online Databases: We leverage online databases, such as industry portals, and academic repositories (PubMed Central (PMC), ScienceDirect, SSRN (Social Science Research Network), Directory of Open Access Journals (DOAJ), NCBI, etc.), to access a wide range of secondary data sources, including market statistics, financial data, and industry analyses.

Data Analysis:

The data analysis phase serves as a critical juncture where raw data is transformed into actionable insights that inform strategic decision-making. Through the utilization of analytical methods such as statistical analysis and qualitative techniques like thematic coding, we uncover patterns, correlations, and trends within the data. By ensuring the integrity and validity of our findings, we strive to provide clients with accurate and reliable insights that accurately reflect the realities of the market landscape.

Transformation of Raw Data:

- Upon collecting the necessary data, we transition into the data analysis phase, where raw data is processed and transformed into actionable insights. This involves organizing, cleaning, and structuring the data to prepare it for analysis.

Utilization of Analytical Methods:

- Depending on the research objectives, we employ a diverse range of analytical methods to extract meaningful insights from the data. These methods include statistical analysis, trend analysis, regression analysis, and qualitative coding.

Statistical Analysis:

- Statistical tools are instrumental in uncovering patterns, correlations, and trends within the data. By applying statistical techniques such as descriptive statistics, hypothesis testing, and multivariate analysis, we can discern relationships and derive valuable insights.

Qualitative Analysis Techniques:

- In addition to quantitative analysis, we leverage qualitative analysis techniques to gain deeper insights from qualitative data sources such as interviews or open-ended survey responses. One such technique is thematic coding, which involves systematically categorizing and interpreting themes or patterns within qualitative data.

Integrity and Validity Maintenance:

- Throughout the analysis process, we maintain a steadfast commitment to upholding the integrity and validity of our findings. This entails rigorous adherence to established methodologies, transparency in data handling, and thorough validation of analytical outcomes.

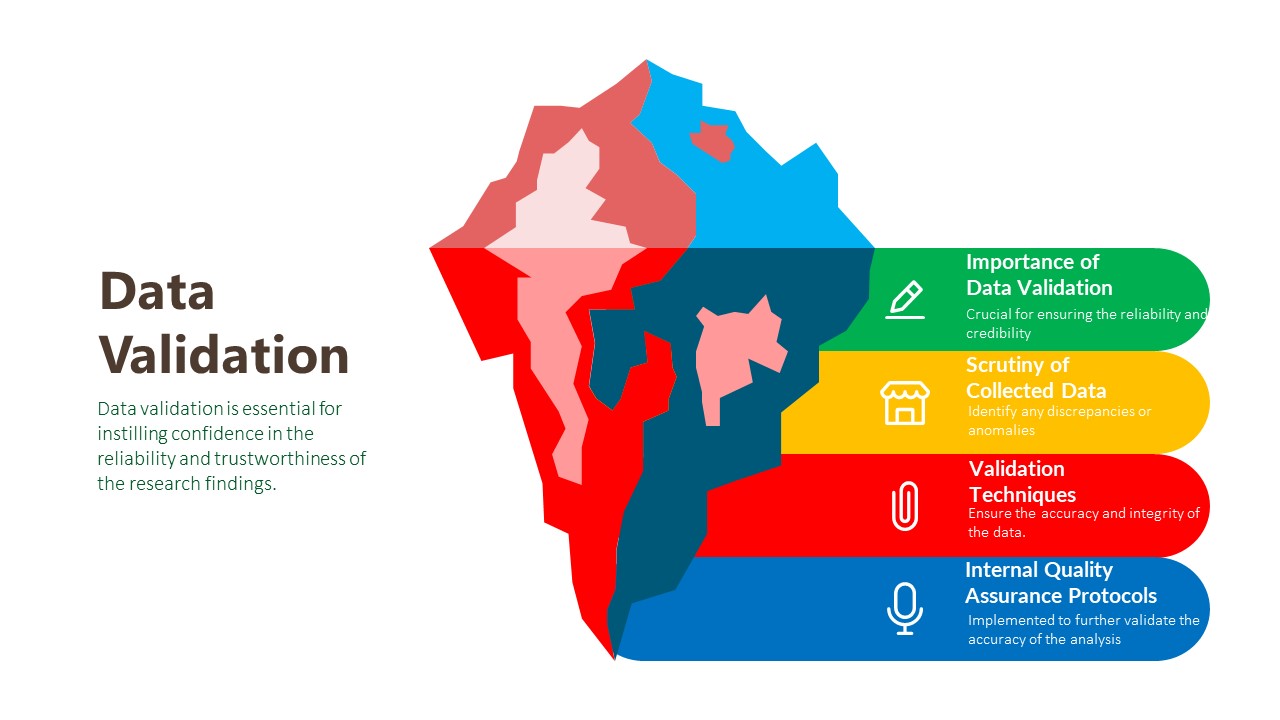

Data Validation:

The final phase of our research methodology is data validation, which is essential for ensuring the reliability and credibility of our findings. Validation involves scrutinizing the collected data to identify any inconsistencies, errors, or biases that may have crept in during the research process. We employ various validation techniques, including cross-referencing data from multiple sources, conducting validity checks on survey instruments, and seeking feedback from independent experts or peer reviewers. Additionally, we leverage internal quality assurance protocols to verify the accuracy and integrity of our analysis. By subjecting our findings to rigorous validation procedures, we instill confidence in our clients that the insights they receive are robust, reliable, and trustworthy.

Importance of Data Validation:

- Data validation is the final phase of the research methodology, crucial for ensuring the reliability and credibility of the findings. It involves a systematic process of reviewing and verifying the collected data to detect any inconsistencies, errors, or biases.

Scrutiny of Collected Data:

- The validation process begins with a thorough scrutiny of the collected data to identify any discrepancies or anomalies. This entails comparing data points, checking for outliers, and verifying the accuracy of data entries against the original sources.

Validation Techniques:

- Various validation techniques are employed to ensure the accuracy and integrity of the data. These include cross-referencing data from multiple sources to corroborate findings, conducting validity checks on survey instruments to assess the reliability of responses, and seeking feedback from independent experts or peer reviewers to validate the interpretation of results.

Internal Quality Assurance Protocols:

- In addition to external validation measures, internal quality assurance protocols are implemented to further validate the accuracy of the analysis. This may involve conducting internal audits, peer reviews, or data validation checks to ensure that the research process adheres to established standards and guidelines.

Report Scope:

Attribute

Description

Market Size

US$ 13,346.0 Million (2030)

Compound Annual Growth Rate (CAGR)

5.40%

Base Year

2022

Forecast Period

2023-2030

Forecast Units

Value (US$ Million)

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

Geographies Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Countries Covered

U.S., Canada, Germany, U.K., France, Spain, Italy, Rest of Europe, Japan, China, India, Australia & New Zealand, South Korea, Rest of Asia Pacific, Brazil, Mexico, Rest of Latin America, GCC, South Africa, Rest of Middle East & Africa

Key Companies Profiled

Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland., Evonik, Dow, Croda International Plc, Roquette Frères., The Lubrizol Corporation, BASF SE, Avantor, Inc., BENEO, and Chemie Trade

Key Questions Answered in Pharmaceutical Excipients Market Report

Who are the major players operating in the pharmaceutical excipients market?

Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland., Evonik, Dow, Croda International Plc, Roquette Frères., The Lubrizol Corporation, BASF SE, Avantor, Inc., BENEO, and Chemie Trade are some of the major players operating in the market.

What are pharmaceutical excipients?

Pharmaceutical excipients are inert substances that are used with active pharmaceutical ingredients (API) in medication formulations to simplify manufacturing, enhance drug distribution, and improve the stability, safety, and efficacy of the finished pharmaceutical product

In the market for pharmaceutical excipients, which formulation group accounted for the biggest market share?

In terms of formulation, the oral formulation segment dominated the market because oral drug administration keeps the drugs’ chemical and physical stability while assisting the manufacturer with packaging and transportation.

In the market for pharmaceutical excipients, which functionality group accounted for the biggest market share?

Based on functionality, the binders sector is expected to dominate the market Due to the rising demand for pharmaceutical and biopharmaceutical drugs as well as the introduction of new products

Which is the leading country in the pharmaceutical excipients market?

Europe is the leading country in the pharmaceutical excipients market.

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

We help clients to procure the report or sections of the report at their budgeted price. Kindly click on the below to avail